The sole difference between holding Ethereum tokens and ETFs is that the latter does not give you staking benefits because anyone who buys Ethereum directly from crypto exchanges gets around 4% of staking rewards each year on top of token appreciation.

As a result, Ethereum ETFs are seeing deep undervalued prices and currently, the US Ethereum ETFs are trading at a 25% undervaluation.

Otherwise, Ethereum would have been the top altcoin ETF bringing in much-needed flows into its markets.

Table of Contents

Ethereum ETFs Are Extremely Undervalued

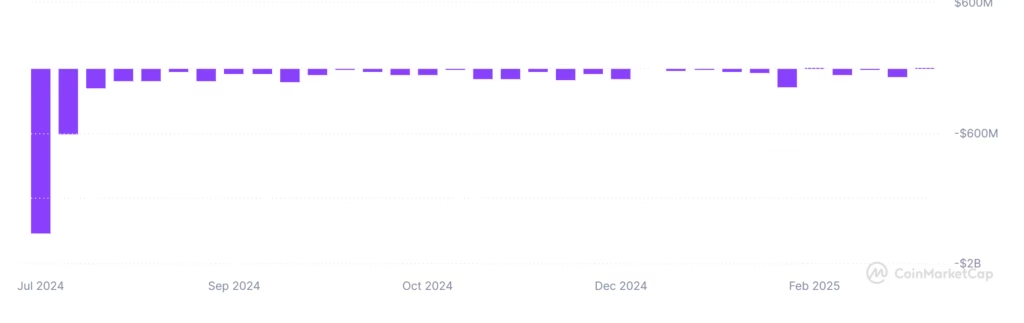

In the last 14 days, Ethereum ETFs have seen a wild amount of inflows shrinking to $6.68 billion in market cap while their AUM is at $8.81 billion. This 25% undervaluation is a bit worrying because, in the broader markets, (both stock and crypto) high undervaluations signal an extremely bearish phase.

Ethereum ETFs Need to Provide Staking Benefits or Risk it All

Ethereum relies on a proof-of-stake consensus algorithm to secure its network. This means that the more people stake in Ethereum, the more secure it becomes. In return, the Ethereum blockchain offers rewards and newly minted tokens.

In other words, staking simply gets you extra money and ETFs do not offer staking at this point. As a result, people do not wish to buy Ethereum ETFs.

If the staking benefits are passed on to ETF buyers, then Ethereum ETFs could attract more buyers for the same reason why Bitcoin ETFs. To achieve that, the ETF issuers must file an amended ETF resubmission with the SEC.

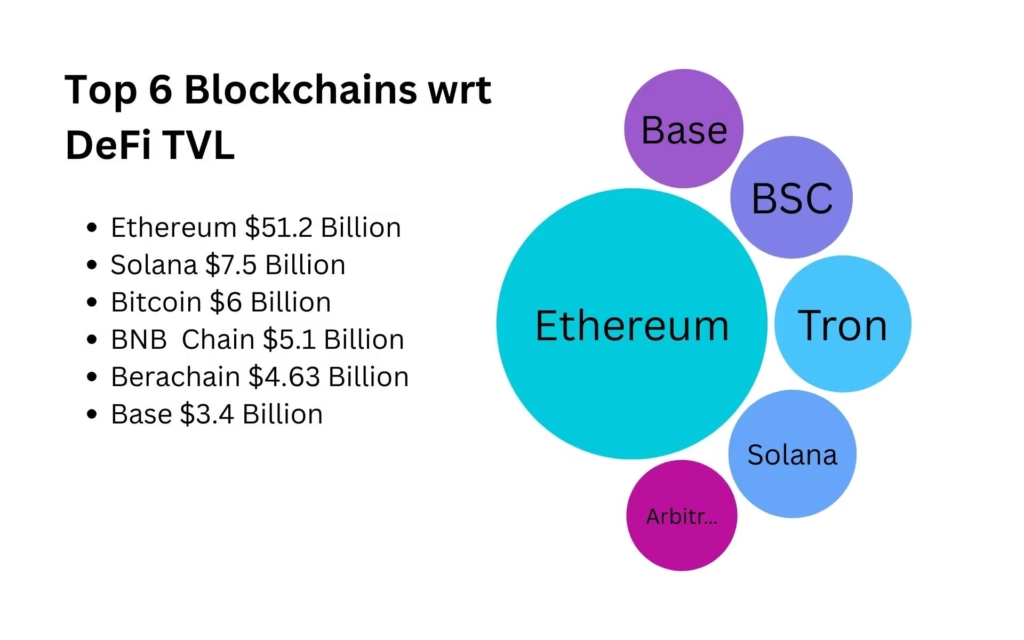

Ethereum Still Has Strongest Fundamentals

Highest Liquidity

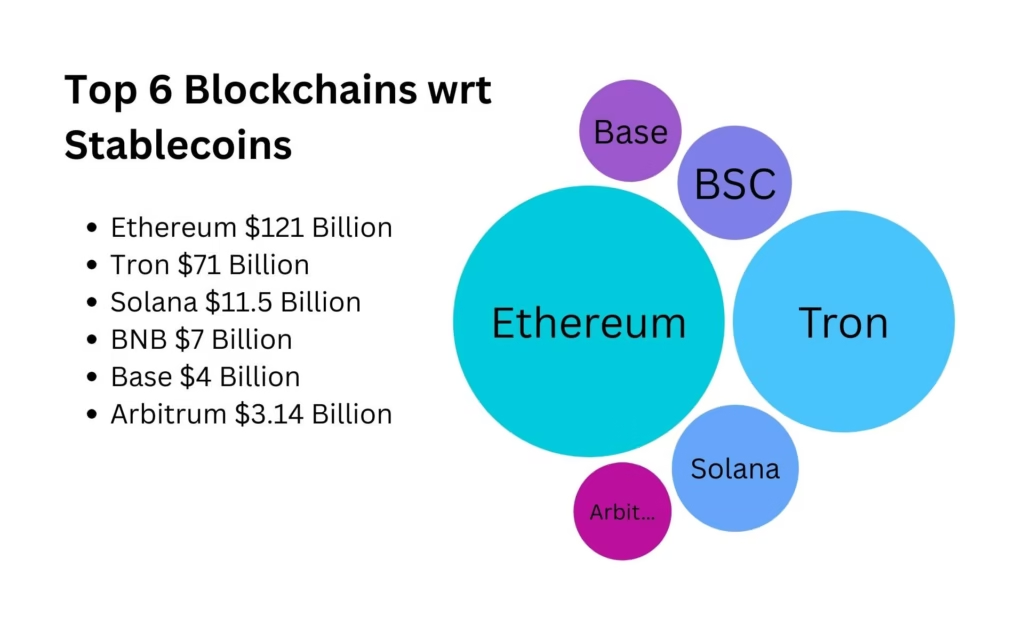

With respect to the value of stablecoins on its chain, Ethereum has around $120 billion worth of stablecoins, beating the next largest one by a $50 billion margin.

Stablecoins bring liquidity to the markets and are essential for investing and trading in any crypto.

Highest Fee Revenue

Ethereum collected the largest revenue in 2024 among all blockchains at $2.5 billion, around 16% higher than the second largest, Tron.

Will Trump Alter ETF Terms via SEC?

Trump is a DeFi millionaire himself (after NFTs, $TRUMP, $MELANIA, and his son’s WLFI), and it is likely that he might have considered this path. However, as a Trump observer since 2016, I expect him to act when Ethereum is at its lowest and he himself has set his own position right (through Derivatives or Spot buying).

To pass staking rewards to the ETF buyers, the SEC’s nod remains a critical step. With pro-crypto candidate Paul Atkins’s takeover, we expect this task to end soon.

Frequently Asked Questions

How many Ethereum ETFs are there?

There are 17 Ethereum ETFs, out of which 13 are in the USA. These 17 ETFs are:

1. iShares Ethereum Trust

2. 21Shares Core Ethereum ETF

3. Fidelity Ethereum Fund

4. Grayscale Ethereum Trust ETF

5. Franklin Ethereum Fund

6. Direxion

7. Proshares Ethereum ETF

8. WidomTree Investments Ethereum ETF

9. Van Eck Ethereum ETF

10. Bitwise Ethereum ETH

11. Ark 21 Shares Active Bitcoin Ethereum Strategy Fund

12. Coinshares Valkyrie Bitcoin and Ether Strategy ETF

13. CoinShares International Ethereum ETF

14. Invesco Galaxy Ethereum ETF

15. Grayscale Ethereum Mini Trust ETF

16. ARK 21Shares Active Ethereum Futures Strategy ETF

17. 21S AFTM