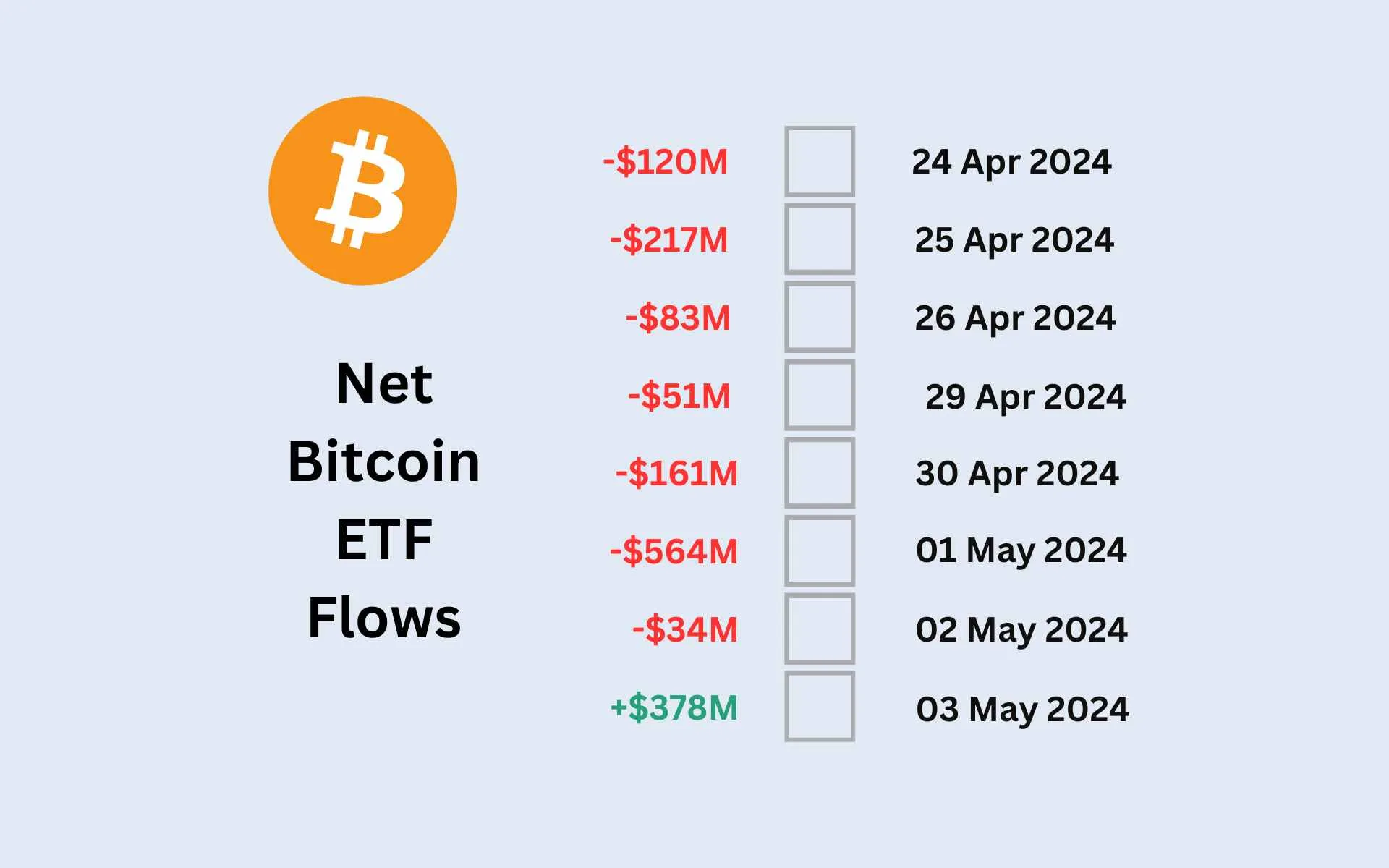

On May 03, 2024, all major US Spot Bitcoin ETFs have recorded a net inflow. This has broken the streak of outflows for the previous 7 days. US Bitcoin ETFs had been witnessing continuous selling pressure due to recent volatility and sell offs by short term investors.

With BTC’s price falling below the average buying price for short term investors, their selling streak has come to an end.

Table of Contents

Bitcoin ETFs Record Net Inflow of $378 million

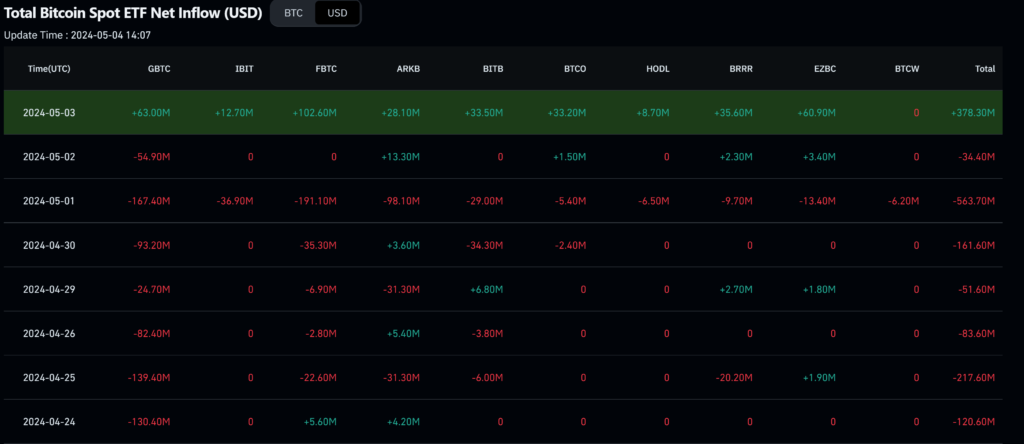

Data by Coinglass shows that on May 03, 2024, all US spot Bitcoin ETFs have recorded a major inflows. This was the first net inflow in about 8 days. Prior to this, there was a net outflow from ETFs which resulted in a selling pressure as ETFs needed to sell their Bitcoins to allow user redemptions.

Although there were some net buying in the individual ETFs, yet the net outflow was hurting Bitcoin prices.

Grayscale Spot Bitcoin ETF Records First Inflow Since Launch

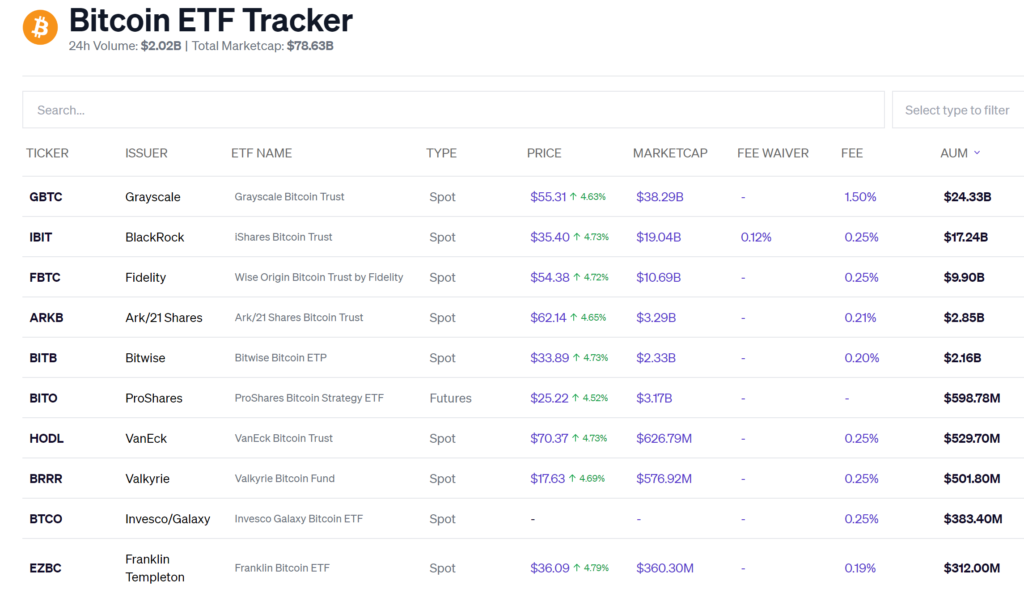

The Grayscale Spot Bitcoin ETF was born from Grayscale GBTC Trust. On the date of the approval of spot ETFs, the Grayscale ETF existed as the trust and had a size of $42 billion.

The availability of new Bitcoin ETFs at lower fees lured investors and the GBTC trust started losing funds at an alarming rate. However, 109 days after the launch of Bitcoin ETFs, the GBTC trust (now Grayscale Spot ETF) has seen a positive inflow of $63 million.

Despite all, the Grayscale Spot Bitcoin ETF still has the highest assets under management, i.e., $24 billion which is still much ahead of the second largest (BlackRock’s IBIT) which is at $17 billion.

Here is a comparison of top Spot Bitcoin ETFs by Blockworks.

#NOTE: In the US, ETFs are registered as legal trusts and the shares of these trusts are sold in exchanges as ETFs.

Reasons for Renewed Buying

Out of several reasons for a renewed buying in Bitcoin, we have identified the top most reasons.

- Bitcoin’s price was suppressed mostly due to short term investors who might have exited after their BTC went below their buying price.

- Quick recovery in Bitcoin’s price after $55k-$57k acted as a strong buying zone.

Failed Hong Kong ETFs

The Hong Kong Bitcoin ETFs failed to perform as the net inflows on the first day of the launch was a little above $8 million as compared to $4.6 billion inflows by US spot ETFs. Even on day 2, the inflows were a meagre $5.56 million vs 1.42 billion by US ETFs on their day 2.