We might soon witness a super rally in almost all major altcoins. We expect a rally in the future because a post-halving rally in Bitcoin is due. Though, there are a few factors that are delaying the Bitcoin and an altcoin rally. However, we expect them to end between Aug- Oct 2024.

Table of Contents

Altcoins Rally Ahead as Bitcoin Enters Post Halving Phase

The Bitcoin post-halving rally might trigger a rally in the altcoins too.

When Bitcoin rallied from $30,000 (June 2023) to $72,300 (April 2024), we also witnessed a similar rally in altcoins too.

- Ethereum rallied from $1900 to $4100.

- Dogecoin tripled from $0.07 to $0.22.

- Solana gave 13x returns from $14 to $200.

- Shiba Inu went 3x from $0.000008 to $0.000024.

- dogwifhat rose 15x from $0.3 to $4.5.

Now considering this was the impact of a pre-halving rally, let us assess what could a post halving rally ( which is much greater) could impact altcoins.

Factors Delaying an Altcoin Rally

The Altcoin rally is pretty much dependent on the post-halving behavior of Bitcoin which itself is dependent on factors such as miners, US Fed interest rates and others.

Miners and Their $5 Billion BTC Stash

Bitcoin miners are estimated currently to have accumulated a stash worth of $5 billion in Bitcoins. Now as the 4th halving reduces their block rewards, they might soon find it difficult to fund operations with a reduced income.

If Miners Sell Bitcoins

If Bitcoin miners decide to sell their BTC holdings, an additional $5 billion worth of Bitcoins would enter the markets. As per 10x Research, that amount is sufficient to keep the Bitcoin prices suppressed at current levels ($60k-$70k) for the next 6 months.

In this scenario, a Bitcoin post halving rally would only materialize in the latter half of 2024, possibly after September.

If Miners Don’t Sell Bitcoins

Assuming that miners don’t sell their Bitcoins or even if they sell, they do so at very small amounts, then the number of new Bitcoins entering the markets would be very low.

In such a scenario, Bitcoin would rally as soon as ETF inflows start pouring in. This could be somewhere in the June – August period.

US Government Actions

The US crypto market is the largest market for cryptocurrencies as well as crypto ETFs. The ability of this market to buy Bitcoin depends upon macroeconomic factors like Federal Reserve interest rates, government taxation policies and other policies.

Federal Reserve Interest Rates

An increase in interest rates would encourage more people to save, as they can earn higher returns on their savings. Additionally, the higher cost of borrowing would deter people from taking out loans.

Conversely, a decrease in interest rates would make borrowing cheaper, encouraging more people to take out loans. This increase in borrowing could lead to greater spending and circulation of money in the economy.

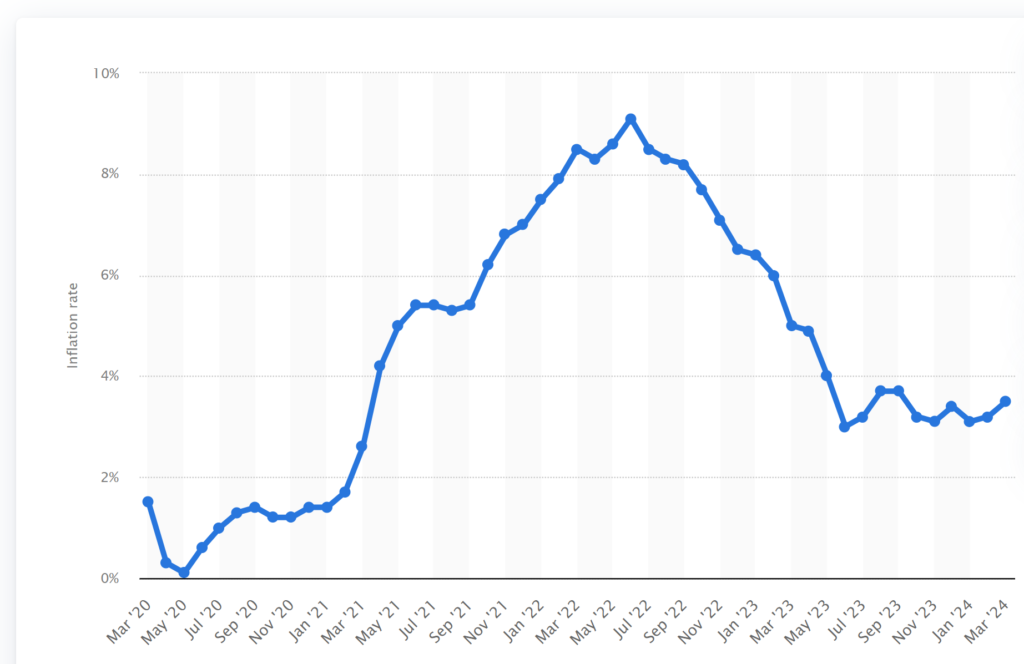

Since Aug 2023, Federal interest rate has been at 5.33%. Being at the highest level since 2009, the high interest rates are forcing people to pay more on their car loans, property loans and student loans. Therefore leaving lesser amount of investable cash with them.

Despite several macroeconomic problems, the US Fed has been trying to suppress inflation by raising interest rates.

However, since Aug 2023, the rates has been constant because if interest rates are raised above these levels, it might bring a recession in the US economy.

NOTE: Germany and Japan have already entered recession as on 25 April 2024.

Now, that the inflation is still above their 2% target (3.5% as of March 2024), there is less expectation that the interest rates will fall soon. This leaves little cash with people and stops them from investing.

New Taxation Policy on Bitcoin Mining

A new taxation policy might be re-introduced for Bitcoin Miners. The US Government is looking to reintroduce a policy which could raise excise duty to 30% on electricity supplied to the Bitcoin farms.

Expensive electricity might force Bitcoin miners to either shut their business or relocate somewhere where taxation policies are favorable.