On 20th April 2024, UTC 12:09 am, the Bitcoin network reached a block height of 840,000 and this triggered the Bitcoin Halving event. This reduced the Bitcoin block rewards from 6.25 Bitcoins per block to 3.125 Bitcoins per block. However, there was also a four fold increase in Bitcoin’s block rewards as compared to the third halving event.

Now that the Bitcoin Halving event has completed. Its finally time to assess what lies ahead now. Turbulent markets, macroeconomics and troubled geopolitics seem to present a lot of challenges ahead.

Table of Contents

Facts About The 4th Bitcoin Halving

- Old Block Reward was 6.25 BTC per block.

- New Block Reward at 3.125 BTC per block.

- Timestamp for the 840,000th block was 12:09 am UTC on 20th April 2024.

- Price of Bitcoin at halving was $63,984.

- Next (fifth) estimated Bitcoin halving date between Feb 4th and April 17th, 2028.

Now that the fourth Bitcoin Halving has finally completed, its time to take a look at what happened and assess what lies ahead.

The halving event took place at 12:09 am UTC on Saturday 20th April 2024 (19th April for the Americas).

The new block rewards is at 3.125 Bitcoins per block as compared to the old block reward at 6.25 Bitcoins per block. However, there is an increased payout. At the 3rd Bitcoin halving, the price of Bitcoin was at $8618 which means a block reward was valued at $53,862(6.25 BTC x $8618). This increased to over $200k (3.125 BTC x $63,984) after the 4th Bitcoin halving.

Bitcoin’s Price to Get 3 Setbacks After The Halving

First Setback: Miners Selling Bitcoins

It is expected that around $5 billion worth of Bitcoins might be sold by the miners. The Bitcoin miners have been sitting at their miner rewards since quite a long time. Now that block rewards are half (3.125 BTC per block), some of them might be forced to sell their Bitcoin holdings.

As per 10x Research this selling might keep Bitcoin under pressure for the next 6 months.

Second Setback: US Government Selling $2 Billion worth Bitcoins

Another seller who is ready to sell their Bitcoins is the US Government which is estimated to hold roughly $14.7 billion in cryptocurrencies. Out of this, approximately $2 billion worth of Bitcoins have already been moved to Coinbase on 2nd April 2024 for selling in the open market.

As per Arkham Intelligence, the government funds were those which were seized from Silk Road, a darknet website founded by Ross Ulbricht (now jailed).

Third Setback: ETF Outflows

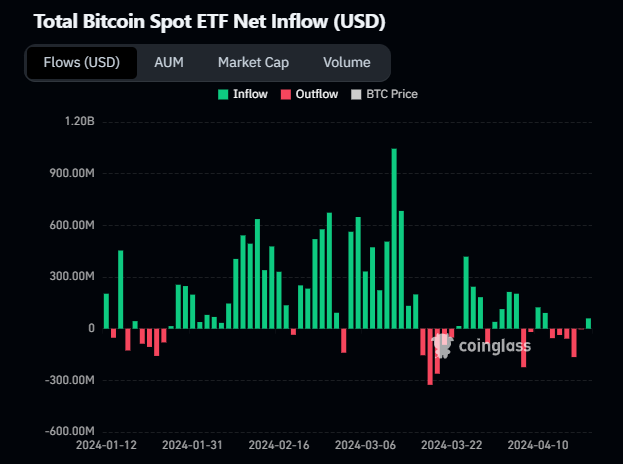

A third setback would be the slowdown in the Spot ETF inflows. Since, their launch, spot ETFs have seen very generous inflows to the tune of $300 million per day. The highest halving recorded till date was on 12th April 2024 when Bitcoin’s price achieved its first all time high in 2024 (previous one was on November 10, 2021).

However, the inflows had stopped prior to the having. You can see the chart below to get an idea of Spot ETF inflows and outflows.

Bad Macroeconomics to Hurt Bitcoin

The US Federal Reserve has clearly suggested that they might not cut interest rates in their next meetings. Fed Chairman Jerome Powell said that the recent readings in US inflation was hotter than expected and this would make it difficult to cut rates in the near future.

Also pointing towards the recent growth data, he said that there were not sufficient steps taken towards achieving the 2% inflation target. Clearly by steps, he meant there could be more rate cuts or neutral policy decisions in the next few FED meetings.

Currently, the US inflation rate is at 3.5%.

The dependence on US inflation and interest rates lies because most of the Bitcoin buyers hail from the USA. Also, the US Spot Bitcoin ETFs far outweigh their global competitors in Assets Under Management (AUM).

Geopolitical Tensions Might Cease Soon

The Iran-Israel conflict seems to have ended for now. The conflict was a major cause of Bitcoin’s fall in price from $65k to $60k a few days ago.

Wars and conflicts typically serve to reduce the market’s appetite for fresh buying.

Fifth Bitcoin Halving Estimated Between 4th Feb 2028 and 17th April 2028

The next Bitcoin halving which will further decrease block rewards from 3.125 BTC to 1.5625 BTC is expected to happen between the 4th of February 2028 and 17th of April 2028. This is considering the average time between Bitcoin blocks to be between 9.5 to 10 minutes.

Price Analysis

After touching a low of $60k, Bitcoin has now bounced back taking $61k as its new support zone. However, there is a resistance near $73.2k.

A move above $73.2k would signal a price rally towards $80k followed by $100k. However, we expect the second target of $100k only to materialize towards the end of the second half (Nov-Dec) of 2024.

A move below $61k would signal a breakdown in prices and Bitcoin might move rapidly towards $50k-$52k which would be a strong buying zone and hence a strong support.

Disclaimer: This analysis is for educational purposes and should not be considered trading advice.

FAQ

What is Bitcoin Halving, How does it Work?

Bitcoin Halving is the event that reduces the Bitcoin block rewards to half every four years. Previous halvings were in 2012, 2016, 2020 and 2024. The latest one in 2024 reduced the Bitcoin block rewards from 6.25 BTC per block to 3.125 BTC per block. This is done to increase the scarcity of Bitcoins.

What does Bitcoin Halving mean for investors?

For investors, Bitcoin halving means profit, as the value of their Bitcoins will increase due to scarcity. Also, it has been observed that a year after every halving, Bitcoin has given phenomenal results to its investors.

[…] Bitcoin Runes were launched with the 840,000th block on the Bitcoin blockchain which also marked the 4th Bitcoin Halving. […]

[…] Bitcoin Runes were launched with the 840,000th block on the Bitcoin blockchain which also marked the 4th Bitcoin Halving. […]

[…] Bitcoin post-halving rally might trigger a rally in the altcoins […]

[…] Bitcoin post-halving rally might trigger a rally in the altcoins […]

[…] outflows are not as severe as they could have been, thanks to the reduced supply of Bitcoin after halving which seems to have held the […]

[…] outflows are not as severe as they could have been, thanks to the reduced supply of Bitcoin after halving which seems to have held the […]

[…] Rekt Capital confirmed that Bitcoin was in a danger zone. This zone corresponded to a phase called post-halving consolidation where the macro-diagonal posed a strong resistance. The phase was indeed marked by […]

[…] Rekt Capital confirmed that Bitcoin was in a danger zone. This zone corresponded to a phase called post-halving consolidation where the macro-diagonal posed a strong resistance. The phase was indeed marked by […]