US Fed’s FOMC Meeting on 18-19 March 2025 and Expectations

The US FOMC Meeting has two possible outcomes, either it could cut interest rates by 0.25% or it may keep them constant at a window of 4.25% to 4.5%.

The US FOMC Meeting has two possible outcomes, either it could cut interest rates by 0.25% or it may keep them constant at a window of 4.25% to 4.5%.

The United States Federal Reserve holds Federal Open Market Committee meetings 8 times every year to decide the base policy rate

Ripple and SEC are scheduled to meet at 2 pm, today on Thursday 13 March 2025 to discuss future of the Ripple vs SEC Case.

Donald Trump is likely to sign a key executive order establishing a zero capital gains tax on crypto.

The White House Crypto Summit is scheduled on March 7, 2025 between 1:30 PM to 5 PM Eastern Time.

Ethereum has been behaving irrationally despite having the following things to its advantage. Ethereum had the highest blockchain revenue in 2024 ($2.5 billion), beating all other cryptocurrencies like Tron, Bitcoin, and Solana. The number of dApps on Ethereum is far…

Businesses that either directly accept Dogecoin or those which are accepting DOGE via third party integrations.

Just like the diesel helps the truck move (i.e., change location), similarly to add any data on the blockchain, you need to spend its native crypto.

Recent data and analyses confirm Bitcoin's ongoing 2024 rally will persist, with predictions of recovery beyond $60k towards $90k. Factors including funding rates, macro-diagonal theory, and halving effects.

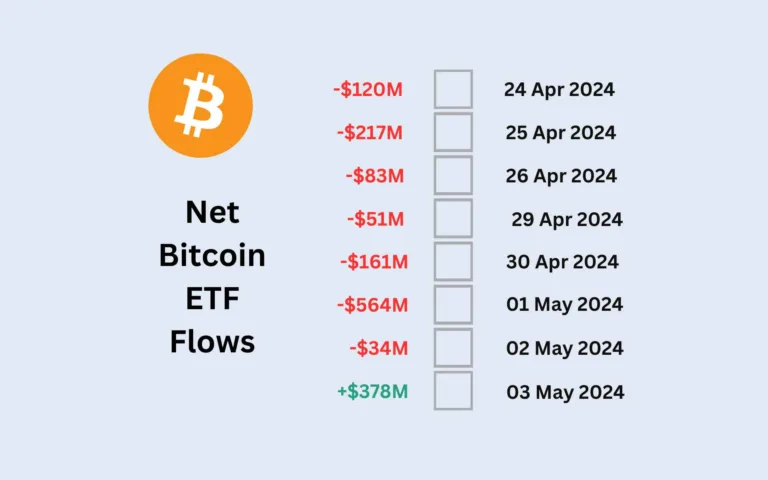

On May 3, 2024, all major spot Bitcoin ETFs recorded their first significant inflows in eight days, totaling $378 million, reversing a previous outflow streak caused by short-term investor volatility.

Severe selling ends in Bitcoin markets that was driven by short-term investors capitalizing on pre-halving bull runs and bullish analyst predictions.

In the past 24 hours, Bitcoin's price dropped from $63,200 to $57,165 due to ETF outflows, a disappointing Hong Kong ETF debut, miner sales, and overall market bearishness. Analysis of on-chain data, fundamental metrics, and technical charts suggests a bearish trend might continue, exacerbated by negative sentiment and external market pressures.