Halving means a phenomenon in blockchains by which block rewards are reduced to half of their previous value. This is done to keep a limit on the amount of new coins entering the circulating supply.

Though halving is not seen in all blockchains, it is mostly common for blockchains with a limited coin supply.

#NOTE: Block rewards are the share of transaction fees that are awarded to those who verify the transactions and add new blocks to the blockchain.

Table of Contents

Definition

Halving refers to the reduction of block verification rewards by 50% every certain number of years (for Bitcoin it is 4). This reduction in the creation of new tokens makes the tokenomics less inflationary, increasing the token value. Further, halving also indirectly forces users to use the blockchain token for their personal transactions, bringing in utility for the token.

#Note: Halving rewards are the only way new tokens are created in major public blockchains like Bitcoin. Therefore, lowering the rewards introduces a smaller number of coins in circulation, helping in token value appreciation.

Why Halving is Necessary? Its Benefits and Significance

Halving becomes necessary in blockchains due to a few reasons. It keeps the coin supply within reasonable limits and therefore helps alleviate the value of the coins. Halving also promotes the usage of transaction fees only to pay miners/validators so that the blockchain becomes intrinsically sustainable.

1. Limit on Coin Supply

Halving works best for those coins that have a limited supply, for example, Bitcoin, which has a limit of 21 million coins.

Further, adding more coins dilutes the value of older coins due following the law of demand and supply.

However, adding a hard cap during the time of launch does more harm than benefit. Because if the blockchain is not adopted instantly, then there would be very less transactions and therefore validators won’t be paid which would make them abandon the work.

Therefore, some token supply is kept as unmined coins which are released slowly to the miners or validators in a controlled manner. This way of releasing new coin supply does not act as a shock and is easily absorbed.

2. Helps Price Appreciation

A reduced coin supply is beneficial as it helps increase the demand of those coins which are in circulation. For example, when Bitcoin halving occurs, it reduced the coin supply and after each Bitcoin halving, the coin value appreciates.

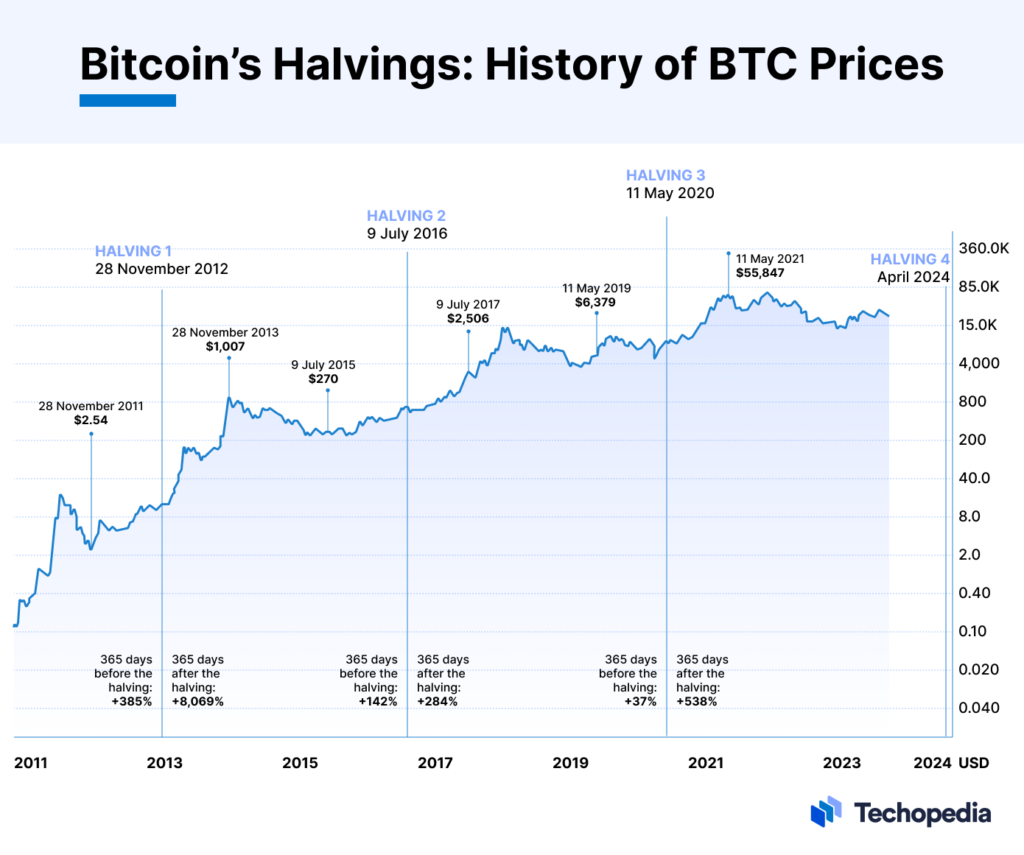

We observed this each time Bitcoin halving occurred. You can see the price of Bitcoin vs halving events below.

3. Makes the Blockchain Self Sustainable

During the initial days of any blockchain, only a few users were use it. However, to keep it authentic there were special users called miners who checked and approved transactions to make sure they were valid.

To encourage these miners, the blockchain automatically rewarded them with cryptocurrencies every time they successfully completed a set of verifications, which we call a block.

However, it couldn’t keep giving out lots of coins forever, otherwise the price of the coin will collapse due to over supply.

So, after a certain number of blocks (every 210,000 in Bitcoin), the rewards became smaller. This would theoretically make the blockchain miners rely more on transaction fees and not on block rewards.

What Happens after Halving?

After halving, usually the price of the coin appreciates as after this situation, there will be a lesser amount of coins that will enter the markets.

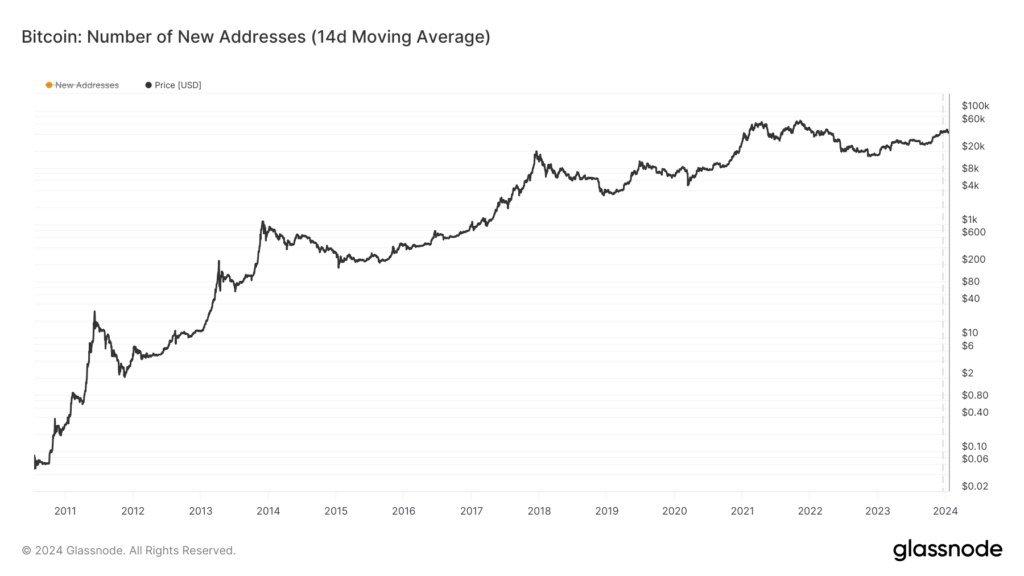

Further, since the block reward decreases, miners/validators get reduced block rewards. However, they also get rewards from increased transactions as more users are seen to be attracted towards the blockchain due to reduced prices.

Bitcoin Halving History

In Bitcoin halving occurs every 210,000 blocks. There have been three halving as of January 2024.

- November 28, 2012 that reduced the block rewards from 50 Bitcoins to 25 Bitcoins.

- July 09, 2016 that reduced the block rewards from 25 Bitcoins to 12.5 Bitcoins.

- May 11, 2020 that reduced the block rewards from 12.5 Bitcoins to 6.25 Bitcoins.

There is also a trend that 1 year after each halving date, Bitcoin’s price grows.

- 1 Year after first halving date : Growth is 8069% (28 Nov 2012 to 28 Nov 2013)

- 1 Year after second halving date : Growth is 284% (09 July 2016 to 9 July 2017)

- 1 Year after third halving date : Growth is 538% (11 May 2020 to 11 May 2021)

First Bitcoin Halving Date 2012

Closing Price of Bitcoin on 28 Nov 2012 was $12.20.

At the beginning of Bitcoin, nobody knew the blockchain and its usage. So, there were not many miners who would want to verify transactions. Therefore a high block reward of 50 Bitcoins($610) till November 2012 was given.

Second Bitcoin Halving Date 9 July 2016

Closing Price of Bitcoin on 09 July 2016 was $650.96.

Slowly, as people began to do transactions on the Bitcoin, its demand increased and as a result, its token price also increased. This increased the value of Bitcoin to $963 by 2016 when the second halving occurred. This decreased the block rewards from 25 Bitcoins to 12.5 Bitcoins(=$8,137) after the halving.

Third Bitcoin Halving Date 11 May 2020

Closing Price of Bitcoin on 11 May 2020 was $8618.48.

The third and the last halving decreased the Bitcoin block rewards from 12.5 Bitcoins to 6.125 Bitcoins(=$53,865.5) after the halving.

#NOTE: There is a trend that after each halving, Bitcoin price increases.

Fourth Bitcoin Halving Date April 2024 (expected)

The fourth halving is expected to occur around April 2024 which will reduce the block rewards from 6.25 Bitcoins to 3.125 Bitcoins. Now if Bitcoin even stays at the price range of $41.5k, the reward per block will still be higher than the last halving (2020) at $130,000 after the halving.

Frequently Asked Questions

Does halving occur in Ethereum?

No, halving does not occur in Ethereum because it is a blockchain with an unlimited token supply. Validators are paid with a combination of new tokens and transaction fees.

Why Bitcoin halving does not occur exactly after 4 years?

Halving occurs every 210,000 blocks and each block does not exactly 10 minutes as expected. Some blocks take more time and some take less, this leads to the mismatch in timing.