- The US Consumer Prices Index (inflation) was at 2.4% against expectations of 2.6%.

- A lower inflation was necessary for a rate cut in the May 6-7 FOMC meeting.

- The US Federal Reserve is likely to go for at least a 0.25% rate cut.

- Bitcoin might recover above $100k and Altcoin markets are expected to recover at least 30% to 50% following the rate cut.

Table of Contents

US Consumer Price Index at 2.4% vs Estimates of 2.6%

The US Consumer Prices Index (inflation) for the month of March 2025 came at 2.4%, close to the 2% target of the US Federal Reserve. Markets estimated the inflation numbers to be at 2.6% for March 2025. Last month, in Feb 2025, the CPI came at 3.1%.

Lower CPI numbers are critical for a rate cut because they signal a cooling inflation. A cooled-down inflation is a necessary precursor to avoid any hyperinflation (inflation above 10% in the USA) scenario.

Since these inflation numbers for March 2025 were the last one before the US Fed FOMC meeting next month, it would prove critical for them to take a dovish way ahead (i.e., help to cut interest rates). An inflation of 3% or higher would have forced the US Fed to go for a delayed interest rate cut.

Will the US Fed Cut Rates? How Much?

The US Fed is most likely to cut interest rates at least by 0.25% and at max by 0.5%. If done, the effective Federal Funds rate would be around 5.12% (a window of 5% to 5.25%) from the current 5.37% (a window of 5.25% to 5.5%).

The reason why we strongly believe in a rate cut ahead is because of the guidance provided by the US Fed in its March 18-19 meeting. The Fed said that starting from April 2025, it would begin quantitative easing, a term used to denote the act of a central bank to infuse liquidity (money) in an economy.

Effect of US Federal Reserve’s Rate Cut

This reduced federal funds rate would help lower interest rates on loans and discourage more people from saving which will help the dollars find their way into the economy.

As a result, crypto and stock markets could see a major rally between 10% to 20%. This rally could give a major boost to the global economy in the short term amid a bitter US-led global tariff war.

Relation Between US Fed Rates and Inflation

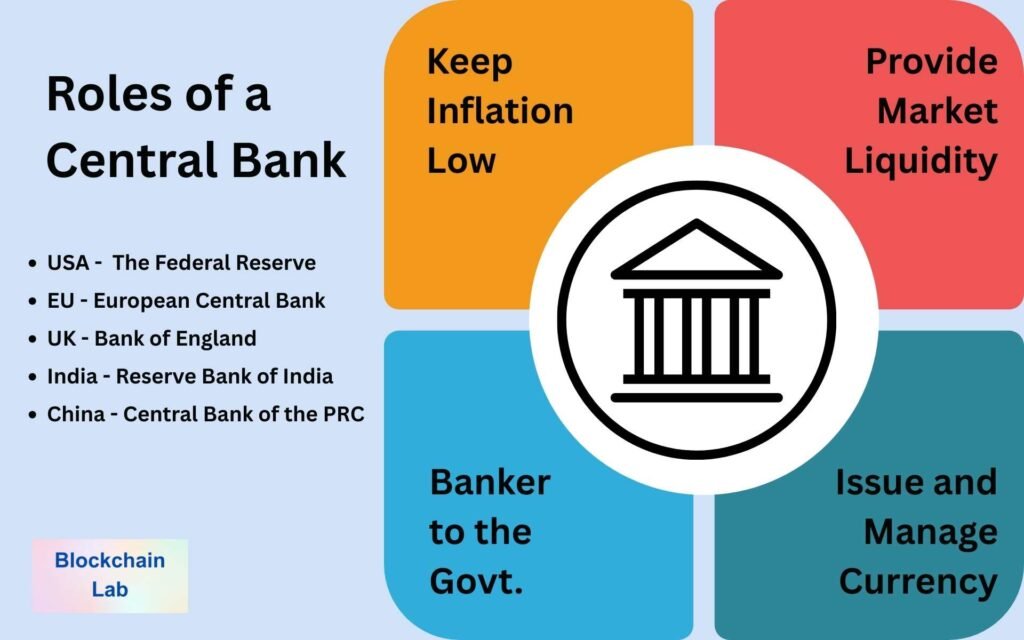

In any economy, the role of setting monetary policy is played by the central bank of that country or economy, for example, the Federal Reserve System in the USA, the European Central Bank in the EU, and the Reserve Bank in India.

A monetary policy basically maintains the supply of money in that country. If the money supply is too high, there would be high inflation whereas if it is too low, the economy would see a recession.

To increase the monetary supply, the central bank lowers the interest rate and lends money at a cheaper rate to the banks. To reduce the monetary supply, it raises interest rates so that people save more with bonds and the loan interest rates also increase, which then sucks all the excess money from the economy.

In the US Economy, this role is played by the US Federal Reserve which makes interest rate decisions based on factors like economic activity, jobs data, inflation figures, and a few other numbers. Among them, inflation plays the largest role. The US Federal Reserve is supposed to keep inflation between 0% to 2%.

[…] period of three months. What had caused this downtrend was the end of the memecoin supercycle, the liquidity crisis in the markets, and Solana’s over-reliance on short-term revenue […]

[…] period of three months. What had caused this downtrend was the end of the memecoin supercycle, the liquidity crisis in the markets, and Solana’s over-reliance on short-term revenue […]

[…] expectation suggests that a rate cut above 0.25% could easily push Bitcoin towards $100k or greater, which makes the current price ($84k […]

[…] expectation suggests that a rate cut above 0.25% could easily push Bitcoin towards $100k or greater, which makes the current price ($84k […]

[…] the US inflation down was necessary, as per the chairman, to keep labor market conditions […]

[…] the US inflation down was necessary, as per the chairman, to keep labor market conditions […]