Dogecoin has been a top cryptocurrency despite the end of the memecoin supercycle in Q1 of 2025. Being a top crypto with millions of holders across the globe lends it decent credibility as an asset. Further, the deregulation of memecoins by the US SEC adds to its popularity.

All of these factors are enough to let Dogecoin have its own ETF in the financial markets alongside XRP, Solana, Ethereum, Litecoin, and Bitcoin.

Also, take a look: List of Businesses Accepting Dogecoin.

Note: Despite Dogecoin enjoying the status of a “deregulated crypto”, its ETF would still be a security because the ETF Trust Shares are securities irrespective of the assets they hold.

Table of Contents

US Dogecoin ETFs

The United States has several top ETF issuers lined up with their Dogecoin ETF applications at the US SEC.

Last year, a Dogecoin ETF would have been a nightmare but this year, they might become a reality soon. The US SEC has seen the approval of the new SEC Chairman Paul Atkins from the US Senate. From Trump’s swearing-in to April 10, 2025, the SEC relied on Acting Chairman Mark Uyeda.

Now that a full-time Chairman has assumed the position, the markets could witness the approval of XRP, Solana, Litecoin, and possibly Dogecoin ETFs too. At present, Dogecoin ETFs have been delayed till May 2025.

Do you know? The US Federal Reserve has a FOMC meeting scheduled on May 6-7, 2025 where it is expected to cut interest rates by 0.25% to 0.5%.

Must Read: Will Trump Announce a Zero Crypto Tax Policy in 2025?

21Shares Dogecoin ETF

21Shares has applied for a Dogecoin ETF application on April 10, 2025. The S-1 application by 21Shares would join a list of two other “colleagues/competitors” for approval.

Grayscale Dogecoin ETF

Grayscale was another major ETF issuer to apply for a Dogecoin ETF in February 2025. Previously Grayscale launched the Dogecoin Trust on 31 Jan 2025.

The SEC accepted its application on Feb 14, 2025.

Bitwise Dogecoin ETF

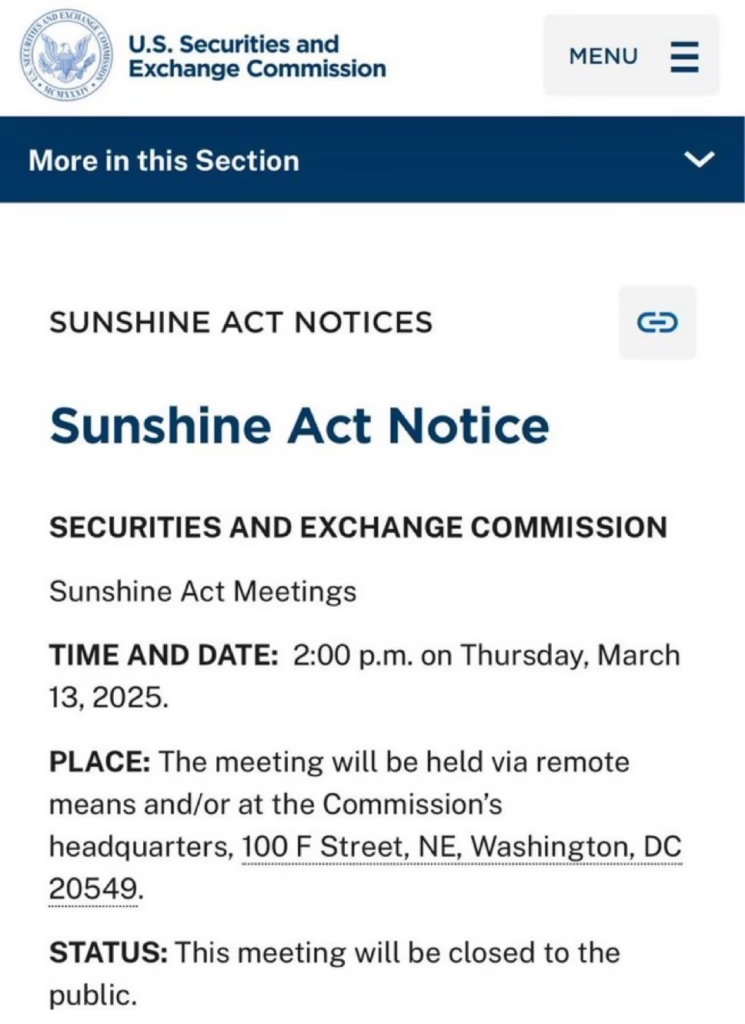

Bitwise was one of the pioneers of a Dogecoin ETF, having applied for a trust on January 23, 2025, and an SEC application on March 12, 2025.

Frequently Asked Questions

Why is the Dogecoin ETF so important?

Dogecoin ETFs are expected to provide liquidity to DOGE in the crypto markets and provide its holders a safe way to buy and hold DOGE without having to worry about the complexity of crypto custody.

How many Dogecoin ETFs are there?

As of April 10, 2025, there are 3 Dogecoin applications with the US SEC. The SEC has acknowledged 2 of them while the 21Shares ETF is at the S-1 application stage.

When will Dogecoin ETFs be approved?

The US SEC has delayed Dogecoin ETF approval to May 2025, most probably because of the change in the SEC’s Chair.