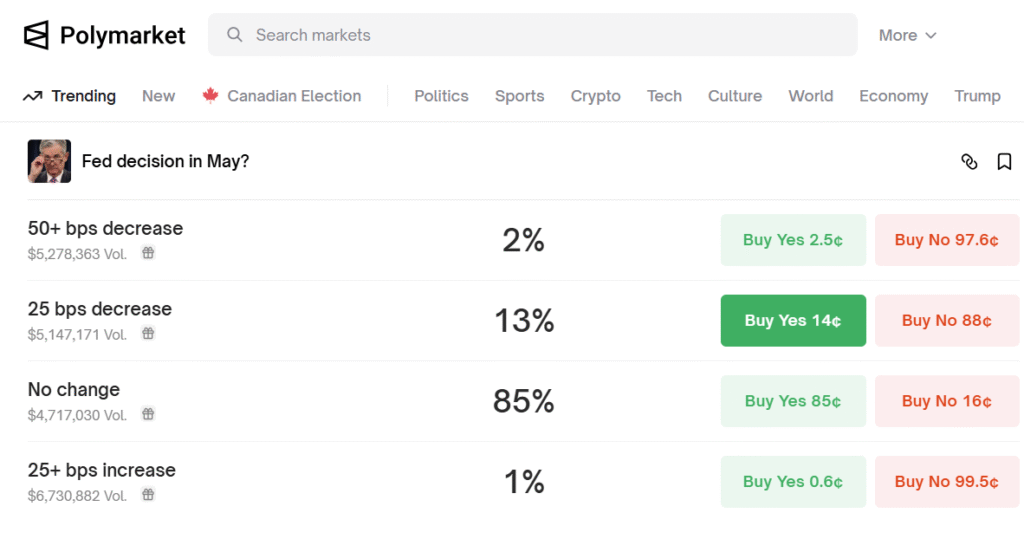

- An overwhelming number of Polymarket users think there would be no rate cuts after the FOMC meeting on May 7.

- Markets desperately want at least a 0.25% rate cut in May, with some optimistic about a 0.5% cut.

- Crypto markets have been going through a liquidity crisis, and the lack of a rate cut could lead to a major crash.

- However, the US Fed has signaled that it would provide some relief in the form of quantitative easing.

Did you know? Polymarket is the largest crypto predictions platform that accurately predicted Donald Trump’s win in the 2024 elections.

Table of Contents

Polymarket Users Shock Crypto Markets

In a shocking turn of events, almost 85% of Polymarket users think that the Federal Reserve will not cut interest rates in the FOMC meeting next month on May 7. Only a 13% minority of users think that there could be a 0.25% rate cut. Further, only 2% of users concur with the possibility of a 0.5% rate cut.

The results of this voting have shocked the markets, which have been expecting a relief from high interest rates which have been sucking liquidity out of the crypto and stock markets. The effective Federal Funds rate is now at 5.37% (repo-reverse repo window of 5.25% to 5.5%). These are the highest levels of interest rates for the US economy after the 2008 Global Financial Crisis.

High interest rates have caused mayhem in the crypto and stock markets in Q1 of January 2025, as there is very little investing power left in the hands of investors (after paying hefty interest rates on loans).

US Federal Reserve Indicates a Rate Cut

Thankfully, the US Federal Reserve has indicated (in its March 18-19, 2025 meeting) that quantitative easing would arrive in the US economy, which is another way of saying that more money will be infused in the US markets to combat the liquidity crisis.

Typically, more money is injected into the economy via lowering the interest rates, which increases the number of people taking debt and hence boosts spending in the economy.

What if the US Fed Doesn’t Cut Rates?

If the US Fed does not cut the interest rates, it would be going back on its statement of quantitative easing, something that has only occurred during a crisis.

Further, this time, as the tariff war between the US and other countries intensifies, it would require a rejuvenation of US manufacturing to stabilize the economy. This is only possible with cheap debt, which in turn depends on low interest rates.

Finally, the inflation in March has also cooled down to 2.4%, making it easier for the US Fed to cut rates further without having to worry about galloping inflation (like 2022).

If the US Fed does not provide a rate cut in its next meeting, it would be knowingly putting the economy in danger, something which has never happened.