Ethereum has been behaving irrationally despite having the following things to its advantage.

Ethereum had the highest blockchain revenue in 2024 ($2.5 billion), beating all other cryptocurrencies like Tron, Bitcoin, and Solana.

The number of dApps on Ethereum is far greater than the number of dApps on other chains like Solana but comparable to BNB.

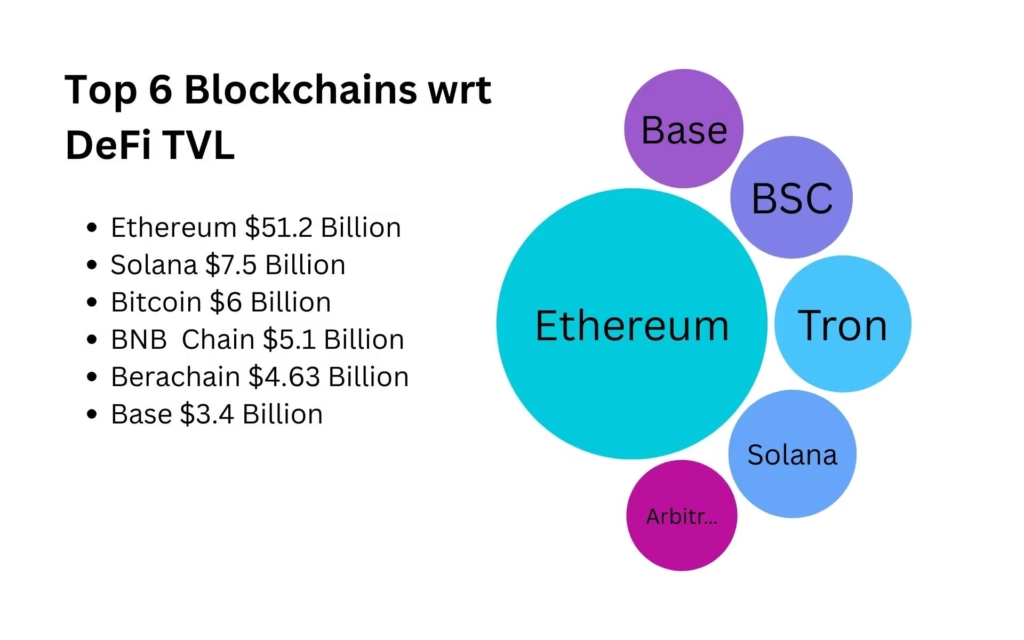

Ethereum’s TVL is at $50.8 billion, about 700% higher than the nearest competitor i.e., Solana ($2.5 billion).

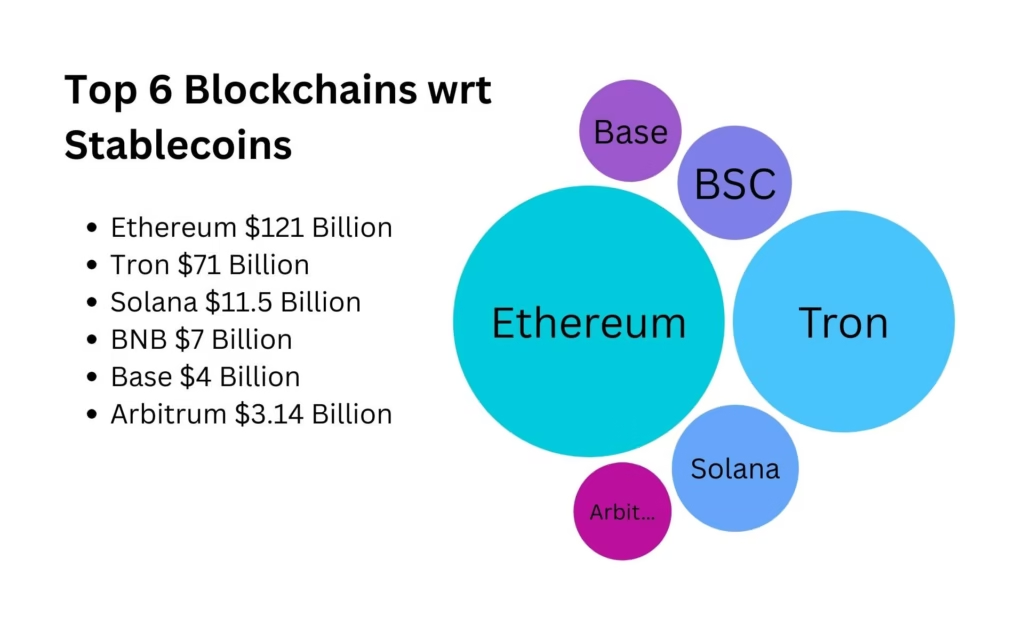

The amount of liquidity that exists on Ethereum is also far greater than other blockchains at $120 billion. Comparatively, Tron has $62 billion of stablecoins and Solana at $11.5 billion.

Why is Ethereum Not The #1 Crypto?

Ethereum should have been the largest cryptocurrency but is way behind Bitcoin at a fraction of its price. There are some rational reasons like corporate support for Bitcoin (which companies thought as the Digital Gold). But there are a few irrational factors too, like Attention Economics.

The Grayscale Ethereum Trust

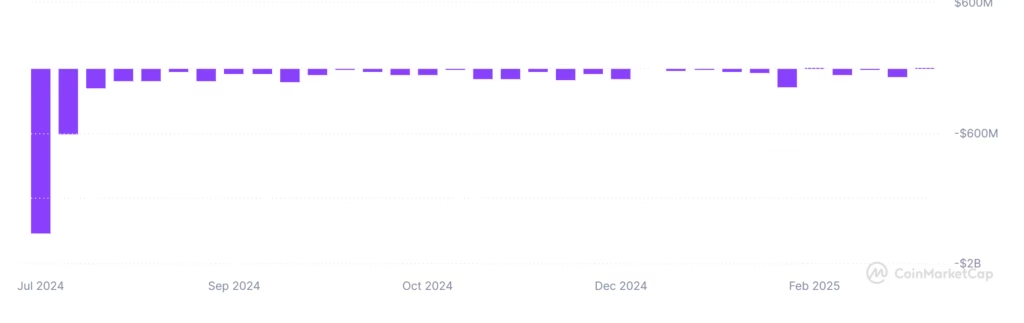

Ethereum’s price has been under selling pressure since the ETF approval. Unlike the Bitcoin ETF, Ethereum ETFs saw wide selling due to one major factor.

The Grayscale Ethereum Trust had amassed $2 billion worth of investments through the sale of its shares. It had a very high fee of 2.5%, which was 10x higher than the fees charged by Ethereum ETFs like BlackRock’s ETHA. As a result, those who had bought Grayscale Trust sold their shares.

This led to a series of redemptions at a point when Ethereum had just touched a high of $4000. Seeing a shorting opportunity based on the Grayscale ETF induced sell-off, crypto markets saw a deep correction in Ethereum, plunging it to $3000 levels in no time.

Disconnect With the Crypto Market Sentiments

Another major reason why Ethereum faced a serious price challenge was its disconnect with the aspirations of broader crypto markets.

To be honest, most first-time crypto users (who form the bulk of the markets) have just entered it to make big profits. For them, cryptocurrencies like Ethereum, Polygon, Arbitrum, or Algorand made little sense. This is why most of them moved towards memecoins, and later towards PumpFun (memecoin creation tool on Solana) to launch their own tokens. This phenomenon is termed as Attention Economics.

Bitcoin had corporate support via ETFs, which was absent in the case of Ethereum. Still, today, most long-term Bitcoin ETF holders are corporate investors who bought them because they cannot show Bitcoin in their balance sheets.

Lately, as these memecoin buyers exit the markets, the attention is expected to shift towards utility-driven projects like Ethereum once again.

Exploring Rationality in Irrational Markets

The worst thing about irrational markets is that they tend to correct when you least expect them to be.

In the current markets, Ethereum could have been the largest blockchain if we think in rational terms.

- It has a much wider application than Bitcoin.

- It has a much larger DeFi TVL than Solana.

- It has a much more sophisticated and well-tested smart contract technology than Cardano.

- It has a much higher blockchain revenue than Tron.

- It has a much higher validator count than all Layer-2s combined.

- It has reduced its blockchain fees by 95% compared to the pre-Dencun Era.

Clearly, Ethereum should be the top blockchain when it comes to deploying dApps

To Invest or Not to Invest

Ethereum’s long-term prospects are very strong, whether it be its blockchain revenue, user activity, on-chain dapps, DeFi TVL, liquidity metrics, or tokenomics. All indicate that the current status of Ethereum is at its strongest point.

Media brands several blockchains as “Ethereum-killer”, yet none of them can consistently defeat it in any major metric, be it user growth, revenue, or on-chain TVL.

Disclaimer: The above report has been made from an informational point of view and is not financial advice. Viewers are advised to seek financial advice before investing.

[…] collected the largest revenue in 2024 among all blockchains at $2.5 billion, around 16% higher than the second largest, […]

[…] collected the largest revenue in 2024 among all blockchains at $2.5 billion, around 16% higher than the second largest, […]

[…] despite the fall, Ethereum continues to lead the markets in all fundamental factors, be it on-chain TVL, stablecoins, fee revenue, or dApp statistics. […]

[…] despite the fall, Ethereum continues to lead the markets in all fundamental factors, be it on-chain TVL, stablecoins, fee revenue, or dApp statistics. […]

[…] Read full article here. […]

[…] Read full article here. […]

[…] Suggested Reading: Data Proves Ethereum Is The Real Market Leader […]

[…] Suggested Reading: Data Proves Ethereum Is The Real Market Leader […]

[…] submitted by /u/emperordas [link] […]

[…] submitted by /u/emperordas [link] […]

[…] by /u/emperordas [link] […]

[…] by /u/emperordas [link] […]