- Bhutan has a GDP of $2.8 billion, ranking 175/196.

- Bitcoin mining has helped it accumulate $750 million in Bitcoin, 26.7% of its GDP.

- Bitcoins could help Bhutan increase its economic situation in multiple ways.

- Acting as a template for several developing countries aiming to lift their economic condition.

Bhutan, one of the few completely landlocked countries of the world, has done wonders that even larger countries could not do. It has mined approximately $750,000,000 worth of Bitcoin, something which stands at 26.7% of its GDP of $2.8 billion.

For a smaller country amidst a global tariff war, this reserve might prove criticial in ensuring economic sustaininability for the country.

The country stands as a shining example of how Bitcoin can help a country alleviate its economic sustainability with just one wise decision.

Bhutan Accumulates 6000 Bitcoins Through Mining

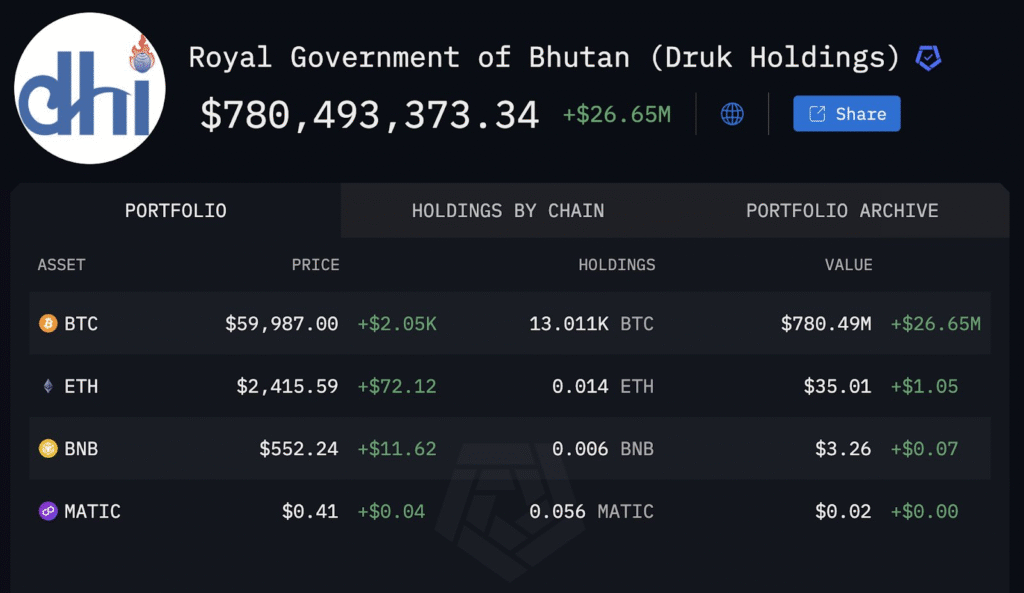

Bhutan has become one of the pioneering states to acquire Bitcoins through mining. Almost all of the 13k Bitcoins held by the Himalayan nation have been acquired via crypto mining, an ingenious way of acquiring Bitcoins with limited resources, something which even major countries were unable to do.

However, Bhutan had an advantage here, being situated between the Himalayan mountains, it has abundant hydropower to generate electricity at low cost, a critical component required to mine Bitcoin.

While other countries remain locked in their legislation around Bitcoin, Bhutan has shown the world that taking action is far more rewarding than endless gossip in the name of policy making.

The entirety of the Bitcoin portfolio of Bhutan has been held under the name of the King, i.e., the Druk Gyalpo Jigme Khesar Namgyal Wangchuk.

Can Bitcoin Help Bhutan Improve Its Economic Situation?

Bhutan’s Bitcoin holdings of $750 million are significant when you compare it with its national GDP of $2.8 billion.

A Bitcoin reserve that is 26.7% of the GDP is one of the best things to happen to any country. Further, since the price of Bitcoin grows rapidly, beating inflation by a huge margin, continuing to hold Bitcoins would help the nation increase its economic situation very rapidly.

How Bitcoin Helped El Salvador?

Just holding the available Bitcoins would help Bhutan avoid any economic crisis in the near or distant future, like it does for El Salvador, a country that needs $1.4 billion for its government reforms. El Salvador, too, has been accumulating Bitcoin, and these holdings now stand at $550 million, just above one-third of the amount it needs for government reforms.

Now, even if the IMF rejects the loan, it can easily monetize the Bitcoin reserves through lending or even using it as collateral and help its government in at least a partial manner.

Note: El Salvador needs the $1.4 billion IMF loan over 40 years, which means it can easily use its Bitcoin reserves as collateral and raise money from elsewhere.

How can Bhutan Monetize its BTC Without Selling?

Bhutan has multiple ways to monetize its Bitcoin without selling it.

- First, it could lend it at a suitable rate and earn an extra income on Bitcoin that is essentially idle.

- Second, it could easily raise funds by using Bitcoin as collateral and using those funds to boost economic activity in the country.