- Bitcoin Mining is still profitable with large professional grade miners.

- Bitmai’s New Antminer S21 pro could help achieve a break even within a year.

- After the Bitcoin Halving, a decline in profit will only occur if Bitcoin does not cross $100k.

Table of Contents

Even with all the criticisms, Proof of Work still remains one of the most secure and rewarding consensus mechanism in 2024. With Bitcoin Halving approaching around the 18th of April 2024, one question strikes all minds – Is Bitcoin Mining still Profitable?

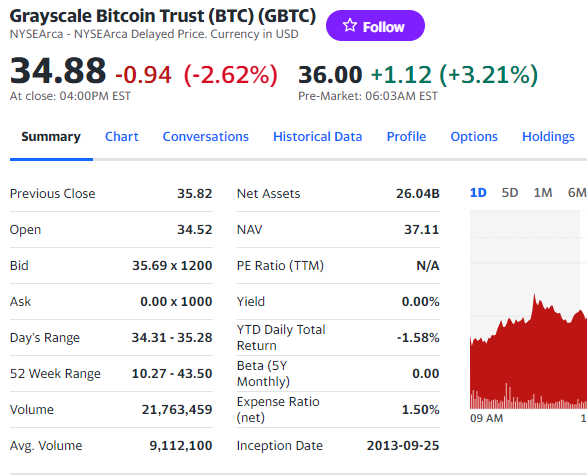

The Answer is yes. If you are using a professional grade mining hardware such as the Antminer S21 (200 Th/s), you would still manage to earn $21 (with electricity cost $16). With latest miners costing around $18.9/Th (Bitmain Antminer S21 Pro), it would barely take you three months to recover your initial setup cost.

Cost of Bitcoin Mining with Antminer S21 Pro in India

One of the most advanced Bitcoin miner from Bitmain, i.e., Antminer S21 Pro has efficiency of 15 J/Th and it can mine Bitcoin at a rate of 250 Th/s. The power consumed by the machine comes around 3000W.

If you consider electricity cost in my region(in Odisha, India), it would cost me somewhere around $0.06 per kWh(unit of electricity). That helps me earn around $16 a day or $500 roughly per month.

With the latest Bitmain Antminer costing around $4,725, take an additional 18% as taxes, it would roughly be around $5575.

Note: You could adjust rates according to your region, taxes and cost of electricity and calculate the profitability of your Bitcoin mining setup.

Effect of the Bitcoin Halving

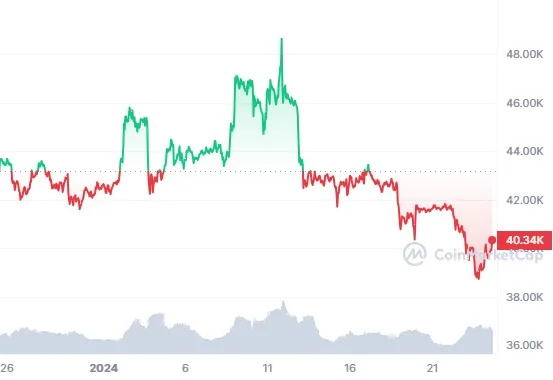

Although the halving will reduce Bitcoin’s block rewards to 3.125 BTC per block, still with the expected rise in Bitcoin’s price post-halving, miners would still be profitable.

With my experience, I estimated same levels of profitability if Bitcoin crosses $100k. Several experts have already signalled that Bitcoin would cross this price levels within H1 of 2022.

Also if the Macro Diagonal Theory proves correct, this price might be achieved by June 2024.

Disclaimer: This post is not a promotional post for Antminer. This study has been done with Antminer S21 Pro as an example.