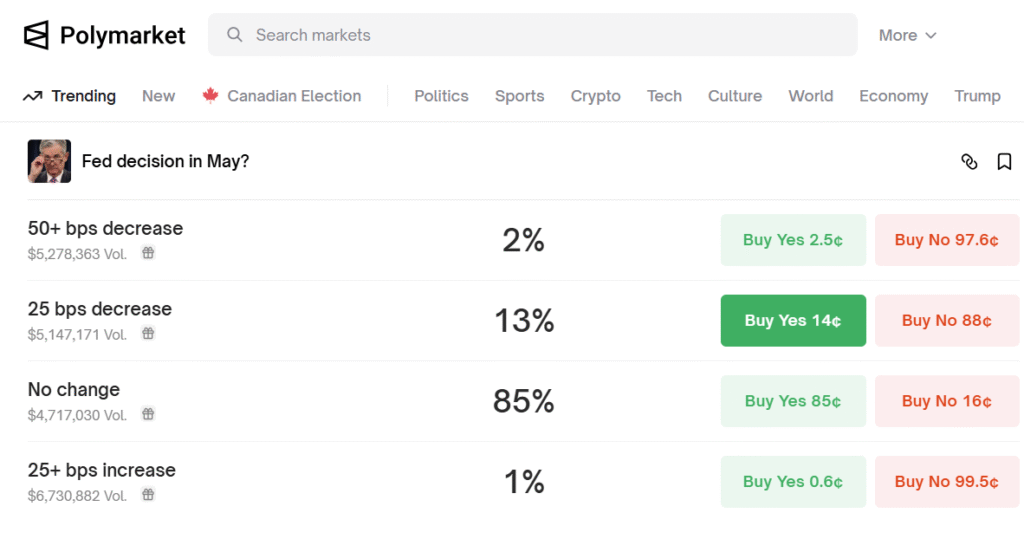

- The US Fed is expected to introduce a rate cut either at the May 6-7 FOMC meeting or the June 17-18 meeting.

- Institutions have already been buying with bigger plans in Q2 and Q3.

- Renewed retail buying of ETFs and spot Bitcoin is expected to take Bitcoin to $150k by September 2025.

Bitcoin Crosses $90k Decisively

In what appears to be a short squeeze, Bitcoin has crossed $85k and $90k within the last 48 hours. This move was expected in late April due to the overwhelming buying of Bitcoins by corporate investors.

Unable to find a way out, most short sellers have either liquidated their positions or have shifted higher towards $100k. The highest number of call options (used to short Bitcoin) now lie at $98k, which is expected to fall soon.

According to put options data, Bitcoin now has a very strong support at $80k and is unlikely to move below these levels even if the US Fed does not make an interest rate cut.

Recovery Should Last This Time

The markets have emerged from severe short selling in the last couple of days, and a faint recovery has taken place in top cryptocurrencies.

These recoveries are expected to last because of strong whale buying in multiple cryptocurrencies, primarily in Bitcoin. Both crypto native and corporate whales have bought at least $3 billion in the last few weeks.

Further, the risk of China selling Bitcoins has been taken as positive news. Historically, whenever China has tightened Bitcoin regulations, the markets have rallied, be it in 2017 (Bitcoin Mining Ban), 2021 (Bitcoin ban), and 2025 (selling of seized Bitcoin).

Upcoming Events That Impact Bitcoin’s Price

The upcoming two Federal Reserve FOMC meetings are expected to aid in the full recovery of crypto markets. The first meeting is to be held on May 6 and 7, while the second meeting is scheduled for June 18 and 19.

May 6 to 7 FOMC Meeting

In the next FOMC meeting, i.e., May 6 and 7, the US Federal Reserve is now expected to keep the rates stable despite a demand for a cut from the US Government.

President Donald Trump and several members of the U.S. Government have raised the demand for Jerome Powell’s removal citing the inability of the US Fed to cut rates amid a similar rate cut in Europe.

The rate cut in the USA has become urgent because of two reasons, the first being the need to restart US industries for which there is a need of cheap loans, and secondly, the US Government needs to refinance its $7 trillion debt in 2025 which it is unlikely to do at prevailing interest rates of 5.25%.

June 18 to 19 FOMC Meeting

If the May FOMC meeting does not cut interest rates, the next one in June is expected to cut them. The US Fed, too, has acknowledged the need for a dovish monetary policy.

However, if the May 6 to 7 FOMC meeting makes the cut, there is less chance of another rate cut in June to prevent inflation from rising high again.

Expecting a Supply Shock

Most of the sellers who had purchased Bitcoin between $80k and $100k in the previous rally are thought to have exited. This exit was visible in the retail market data, where retail ownership in Glassnode’s chart was at its lowest since November 2024.

Opposite to this, the corporate accumulation has been rising, and as per a Glassnode’s index, corporate accumulation has increased from 0.2 to 0.6.

Further, there is more interest pouring in from other corporations like Strategy and GameStop, both of whom are yet to make their purchases worth more than $10 billion (combined).

Since, at present not much of the markets are in selling mode, Bitcoin could see a supply shock as soon as the Fed cuts the interest rates.