- Ripple and SEC are scheduled to meet at 2 pm, today on Thursday 13 March 2025.

- The meeting could solve the differences between the SEC and XRP under new SEC Chair Mark Uyeda (a Republican).

- SEC had previously appealed against lower court’s decision that termed XRP as “not a security”, while having fined it for $125 million.

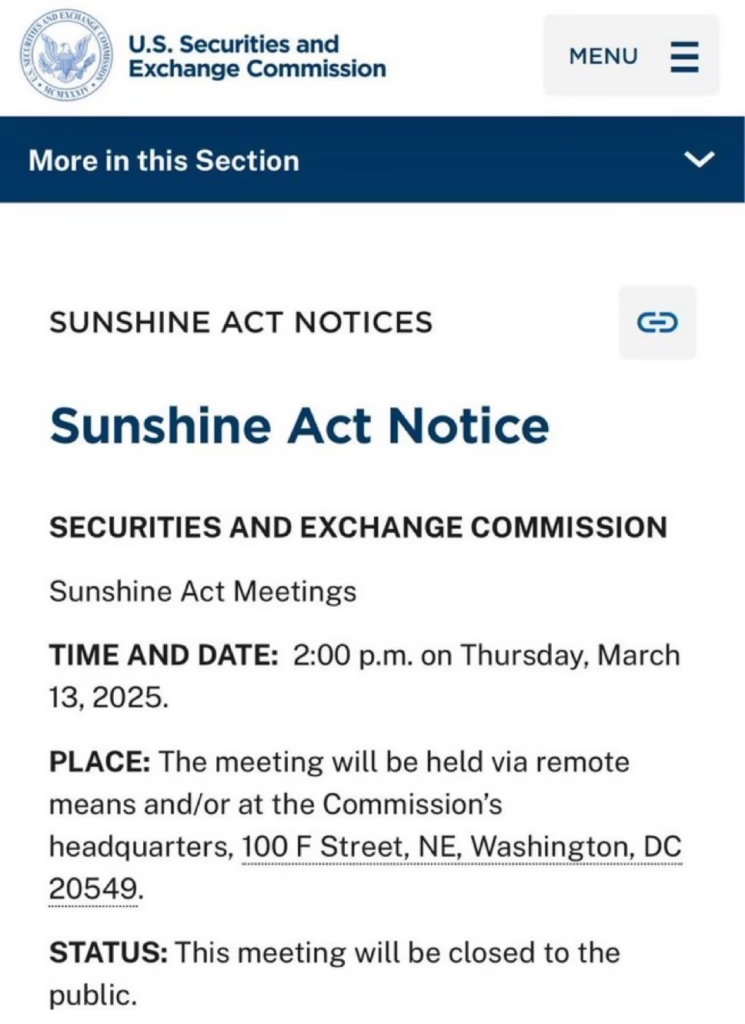

The SEC has released a press statement regarding its upcoming meeting with Ripple under the Sunshine Act. The meeting will be held online between Ripple Executives Brad Garlinghouse (CEO), David Schwartz (CTO), Stuart Alderoty (Legal Counsel) and a few other possible executives.

On the behalf of the US SEC, there would be Mark Uyeda (acting Chairman) and three SEC Commissioners (as Elizabeth Crenshaw was not re-appointed in Jan 2025).

The notice discloses the time of the Ripple-SEC meeting as Thursday 13 March 2025. Ripple and SEC could solve their differences in this meeting, potentially leading to the end of a four-year long case against Ripple Labs and its executives (filed in December 2020).

What Does it Mean if SEC Drops the Case?

There is a very high possibility that the SEC drops the case as Acting Chairman Mark Uyeda (a Republican) could follow Trump’s pro-crypto initiatives.

Further, as a result of Trump’s liberal crypto policy, Ripple could become the largest cross-border payment settlement platform. It is already the largest player in the blockchain-based cross-border settlement space.

Additionally, since XRP is the primary token to pay gas fees on the XRPL blockchain, the result meeting could increase the demand for this token. Besides being used for cross-border settlements, XRPL is also used for issuing and transacting RLUSD stablecoins, for RWA (Abrdn’s Tokenized Liquid Fund), for using Ripple On Demand Liquidity Platform, and for several other uses.

If SEC drops the case, Ripple’s XRP could shoot upwards of $3 within a week, according to our expectations.

The Ripple vs SEC Case Timeline

Ripple was accused of selling $1.3 billion worth of unregistered securities to retailers and corporate investors in 2013 (the XRP ICO) following which the SEC registered a case 7 years later in December 2020.

The case saw several developments over the next four years finally culminating in a ruling by the District Court of the Southern District of New York. The ruling termed that the retail sales of the SEC were not securities and quashed the SEC case in August 2023. Whereas, the corporate sale were later termed as securities but the courts imposed only $120 million fine on Ripple Labs, against a demand of $2 billion from the SEC.

The case has now been pending in front of an appellate court where the SEC has challenged the ruling of the lower court.

The meeting scheduled on 13 March 2025 is expected to settle the matter for once and for all.

Leave a Reply