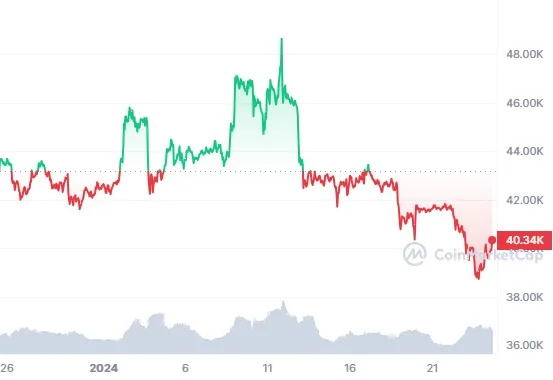

Bitcoin has witnessed a selling pressure after the ETFs were approved on the10th of January 2024. The cryptocurrency made a high of $48,939 on 11 Jan 2024 after the ETF approval. The price then fell to $38,521 on 23 Jan 2024 witnessing a sell-off which was accompanied with rumors of profit booking.

Table of Contents

FTX Sells $1.6 Billion GBTC Shares due to Bankruptcy

Although, there was a bit of profit booking taking place in the market, yet, the main reason we found was that FTX sold nearly $1.6 billion worth of Grayscale Bitcoin Trust (GBTC) shares. Since the shares were redeemed by FTX, the Bitcoin in those shares had to be sold off which cost the market to fall.

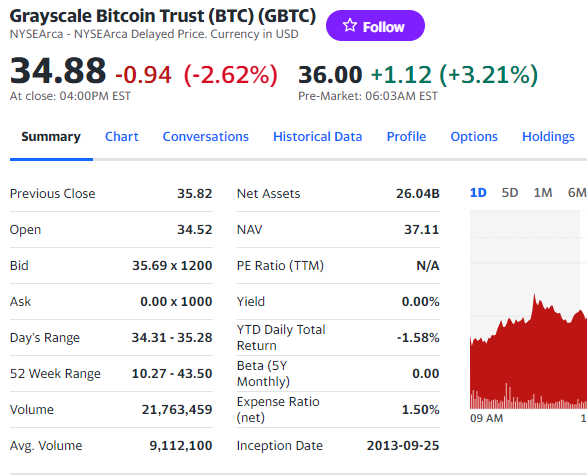

In total, GBTC saw outflows of about $2 billion out of which, FTX alone sold $1.6 billion worth of shares. The bankruptcy of the FTX made it compulsory for it to sell those shares to pay its debtors which sold 22.28 million shares were sold via Mirax Capital.

Grayscale Bitcoin ETF became the largest one after the Grayscale Bitcoin Trust was allowed by the SEC to convert it into an ETF. At the time of the conversion, the net value of assets under management were $28.6 billion.

As on 24 Jan 2023, it still has $24 billion with of assets.

#NOTE: The Grayscale Bitcoin Trust had bought Bitcoins on the basis of whose value, it issued shares. Anyone with a GBTC share was entitled to own a part of those Bitcoins.

Experts Comments on Bitcoin Sell-off

We have gathered few expert insights that help us decode the post ETF sell-off in Bitcoin.

Markus Theilsen, Head, 10x Research

In his WhatsApp community (of which I am a member), Markus Thielen noted that FTX sold off at least $1.6 billion Bitcoins in two tranches.

The first tranche was sold on 23 Jan 2024 which had $1b worth of Grayscale’s Bitcoin ETF.

The second tranche had nearly 17,140 Bitcoins and it was deposited to Coinbase on the same day. The value of the second tranche was nearly $660 million.

Cathie Wood, CEO, ArkInvest

Appealing on the CNBC ArkInvest CEO Cathie Wood said that now the Bitcoin ETFs are now available at very reasonable price. This helps retailers to buy Bitcoins at a very small price.

She also shared that FTX was selling the shares of Grayscale Bitcoin Trust worth over $1 billion which currently is the main reason behind the decline of Bitcoin’s price.