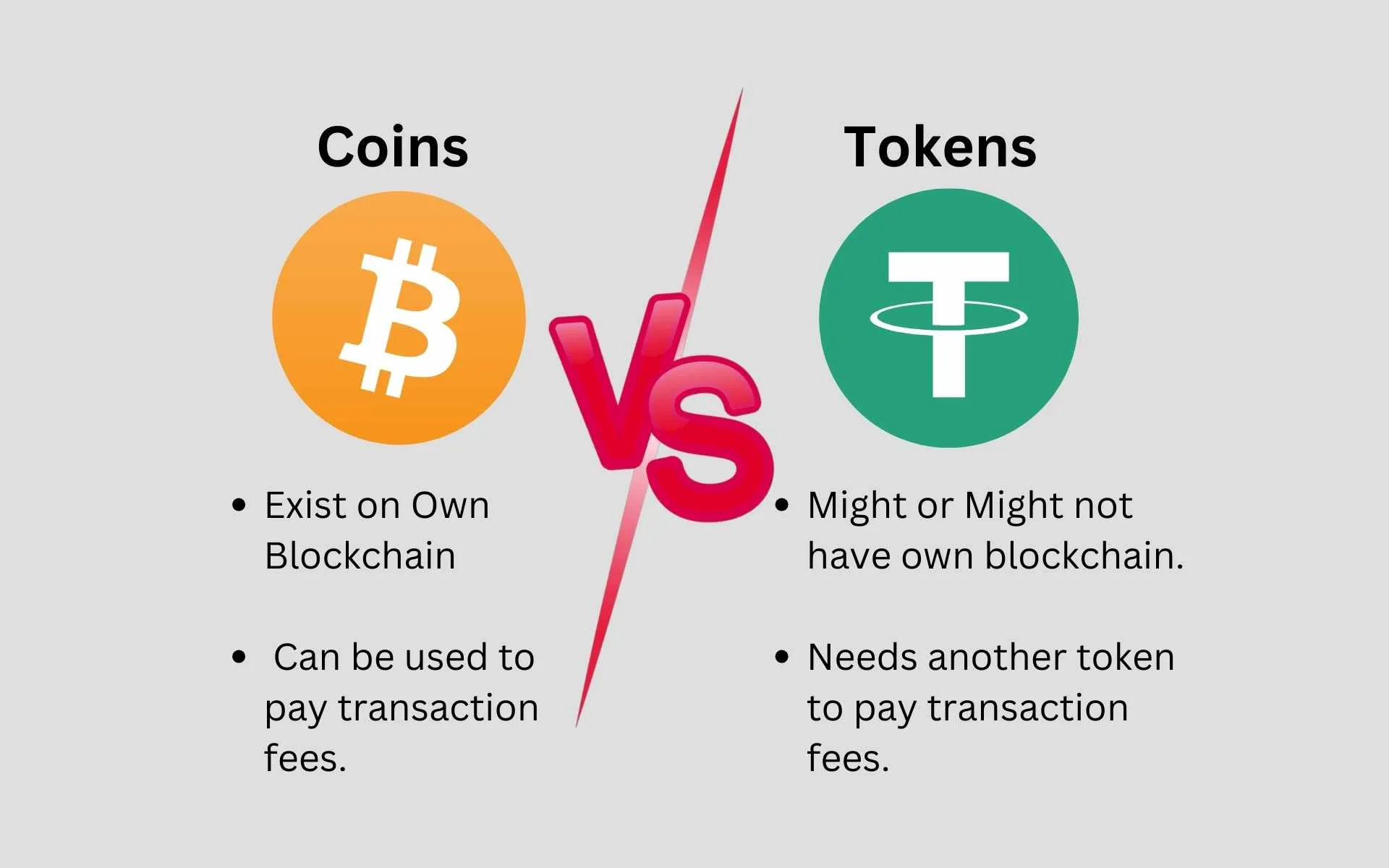

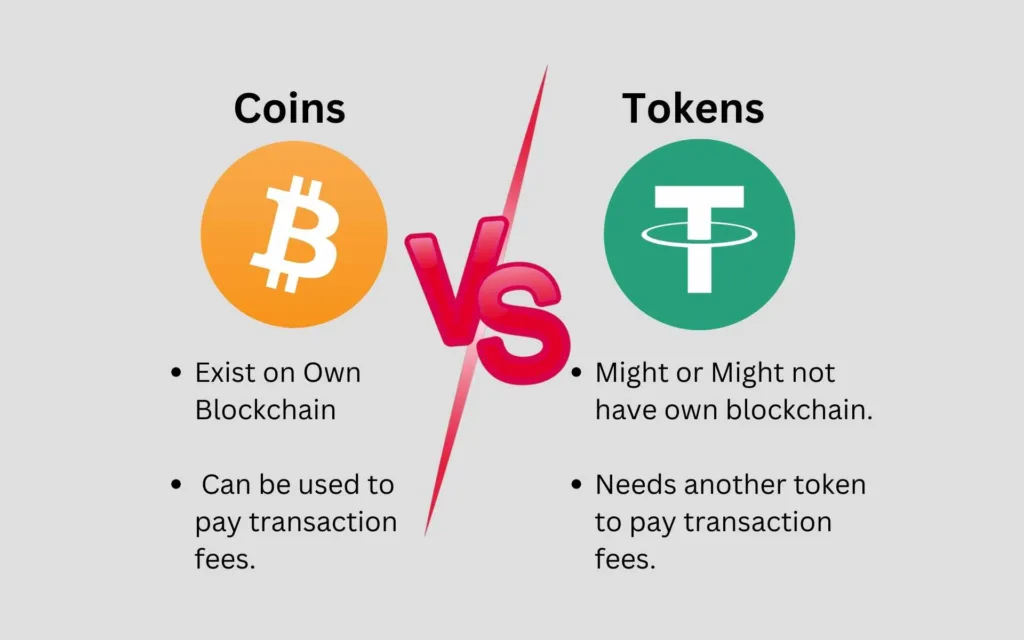

Cryptocurrencies is the widest term of all and covers all type of digital currencies irrespective of blockchains. Coins are those cryptocurrencies which exist primarily on their own blockchain. Tokens are those cryptocurrencies which exist on other blockchains; and might or might not have their own blockchain.

Let us explore briefly the confusion between coins vs tokens and understand what make them different.

Table of Contents

Definitions

Cryptocurrencies are digital assets on a blockchain that can be used in a similar way as fiat currencies. They satisfy all the requirements of a currency such as fungibility, store of value and are widely accepted.

Properties of Fiat Currency

Fiat currency has some properties which must be followed by every asset that need to be called a currency. Some of them are fungibility, storage of value and wide acceptance.

Fungibility

Fungibility is the property through which an asset such as a currency can be divided in to smaller parts. The following two examples depict how Bitcoin is more fungible than fiat currencies such as US Dollar.

For example:

- A US Dollar($) can be divided into 100 cents.

- An Indian Rupee (₹) can be divided into 100 paisas.

- A Bitcoin can be divided in to 100 Million Satoshis.

Store of Value

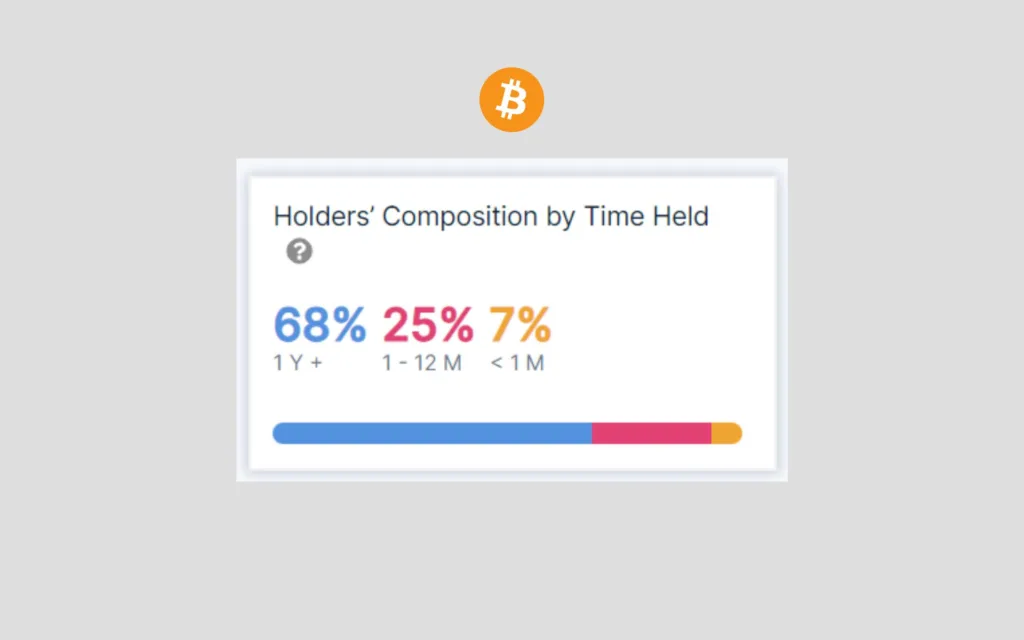

Store of Value is the property of currencies which helps people store them for future needs. Currencies need to have a way through which they can be stored and be of value even after a long time. Cryptocurrencies can be held on as savings or investments and can be used at a late stage.

The above image shows how more than 68% of Bitcoin owners have held to their Bitcoins for over a year now.

Wide Acceptance

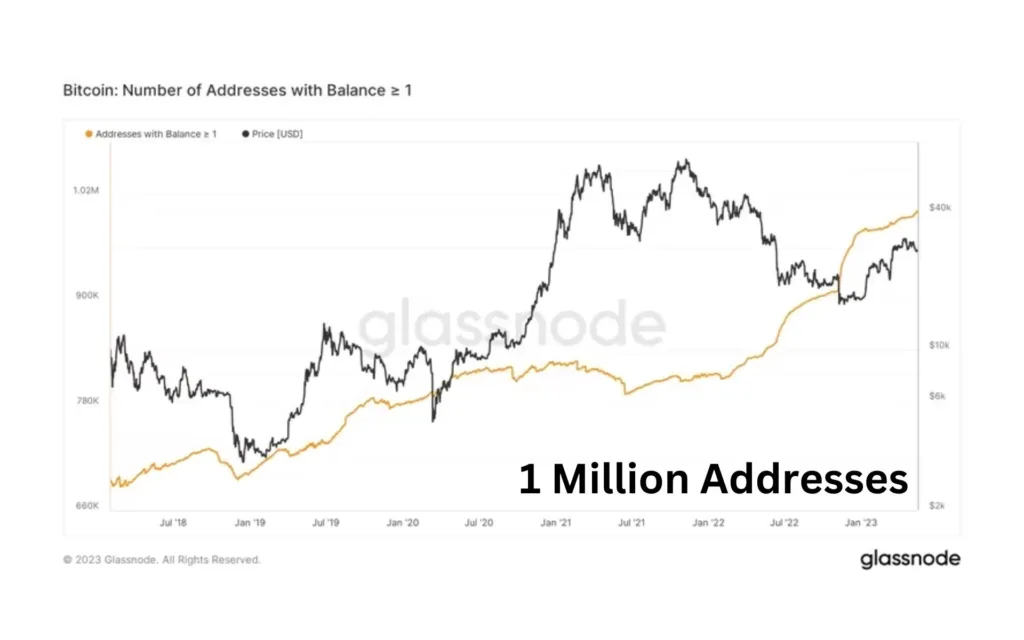

Wide Acceptance is also a major aspect of a currency because it cannot be freely used otherwise. Cryptocurrencies satisfy this aspect as millions of people across the world, including me, accept cryptocurrencies as a mode of payment.

Coins vs Tokens

By definition coins are those cryptocurrencies which have their own blockchain. For example, Bitcoin has its own blockchain where its cryptocurrency exists. Similarly, Shiba Inu is a coin when it exists in its own blockchain, Shibarium.

Tokens are those cryptocurrencies which either do not have their own blockchain or are those which are transferred to a different blockchain.

For example, USDT is a token on the Ethereum Blockchain because USDT does not have its own blockchain. Similarly, Shiba Inu when it is an ERC20-standard token, it is a called to be a token on the Ethereum blockchain and not coin.

Let me give you another example. Bitcoin is a coin on its own blockchain but when it is send to the Ethereum blockchain, it takes the form of a ERC20-token called Wrapped Bitcoin (wBTC). This Wrapped Bitcoin is a token on the Ethereum Blockchain.

Fungible vs Non-Fungible Tokens

Basically, fungible tokens ae those which can be divided into smaller units and non-fungible tokens are those which cannot be subdivided.

#NOTE: There is another token category on Ethereum called Semi Fungible token which can be issued in both fungible and non-fungible forms. Its token standard is ERC-1151.

Fungible Tokens

Fungible Tokens are those which can be divided into numerous smaller denominations which can be sent and received independently. For example a Bitcoin can be divided into 100 Million Satoshis each of which can be sent individually.

#NOTE: This property of Bitcoin which enables independent transaction of each Satoshi, has given rise to Ordinal Theory based on which Bitcoin Ordinals (NFT-like tokens on Bitcoin’s blockchain) were created by Casey Rodarmor.

Non Fungible Tokens

On the other hand Non-Fungible Tokens are those which are transacted individually and cannot be divided into smaller groups. These tokens are minted on a blockchain and can be transferred to other blockchains via cross-chain transfer protocols such as a Blockchain Bridge.

Non-Fungible tokens usually represent digital or real world assets and can be used to trade the ownerships of these assets. For example, real world land or building can be tokenized and sold via the blockchain. This process is called as Asset Tokenization.