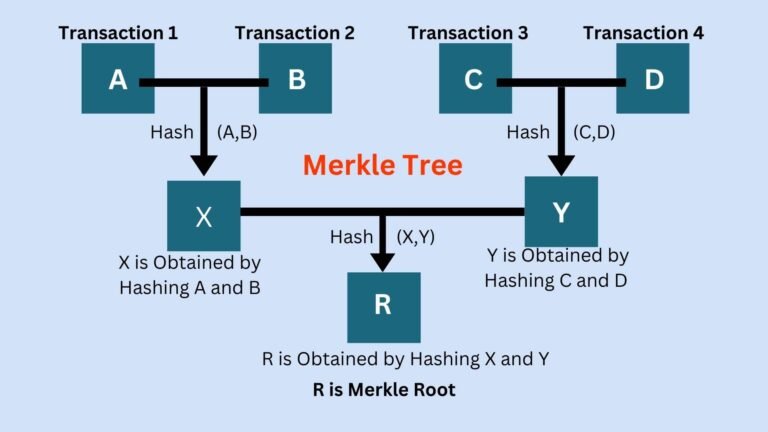

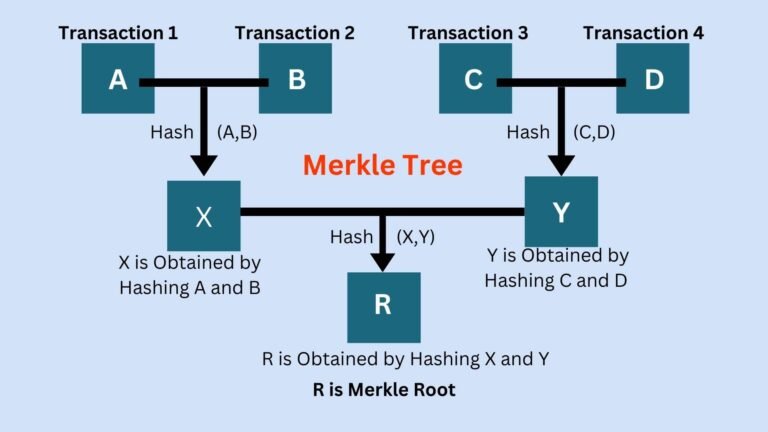

What is Merkle Root and Merkle Tree?

A Merkle Root is the hash of all the transactions in a block by hashing transactions till the time there exists only a single hash result for the entire block.

A Merkle Root is the hash of all the transactions in a block by hashing transactions till the time there exists only a single hash result for the entire block.

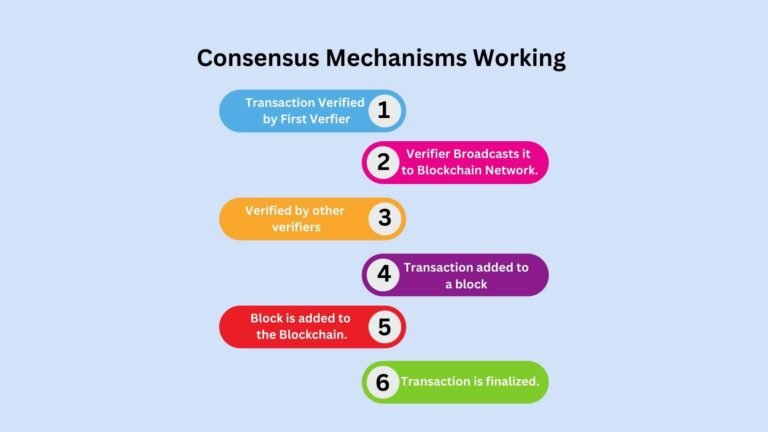

Consensus Mechanisms are different ways to verify blockchain transactions by running it through multiple validators each of whom verifies them individually.

A testnet is a replica of the mainnet with reduced security and reduced network capacity meant to simulate the mainnet for testing purposes.

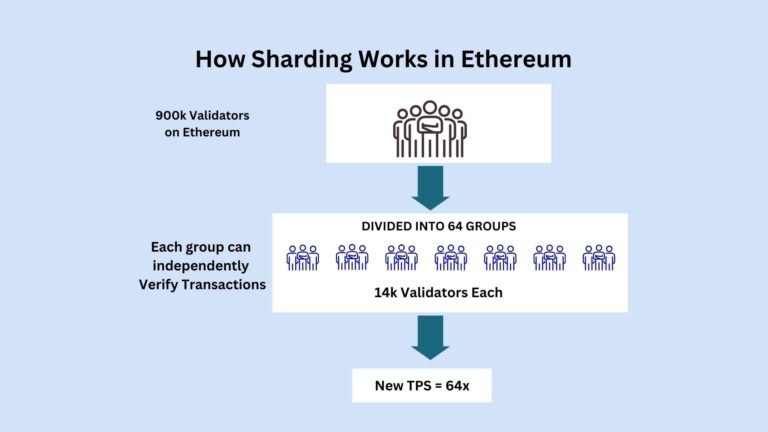

Sharding is the process of breaking a blockchain's total no. of validators into smaller groups called "Shards". Each shard has its own unique set of validators.

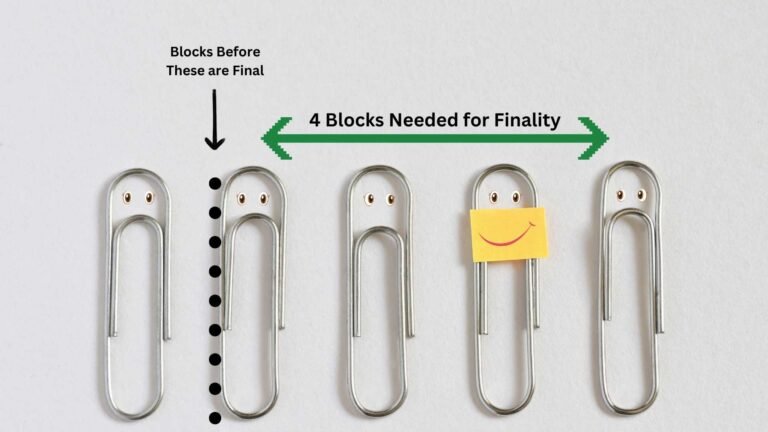

Finality refers to the situation where a blockchain transaction is permanent and cannot be reversed. For Bitcoin, the blockchain finality is after 6 blocks.

Difficulty is the computational effort required to find the nonce value of a transaction in a blockchain.

This is the calculator which converts Shiba Inu to USD.

Shiba Inu is a meme coin created by the pseudonymous developer Ryoshi as a response to Dogecoin.

A blockchain is a set of blocks each of which records details of several transactions. Together, it creates a distributed ledger that is nearly immutable.