- Top crypto analyst Markus Thielen brought the attention of the crypto markets to low market activity.

- The largest traded pair on 18 April was USDC-USDT, both stablecoins.

- Lack of clarity on US Fed interest rates seems to be the key reason for this stagnancy.

- The markets might experience high volatility around May 6-7 due to the FOMC meeting.

Table of Contents

Top Market Analyst Brings Attention to Low Activity

Top crypto analyst and a known figure in crypto markets, Markus Thielen of 10x Research, had shown that the most traded pair on April 18 was the USDC-USDT, both stablecoins.

#NOTE: The most traded pair yesterday, USDT and USDC, is traded by those who might need to convert their holdings from one chain to another.

This was further validated by CoinMarketCap data, where USDT was the most traded crypto.

18th was the Least Active Day in April for the Markets

The month of April has seen one of the lowest crypto market trading volumes in recent times. Market volumes plummeted from $3 trillion in December 2024 to $1.45 trillion in March 2025. Within the first three weeks of April, these volumes have gone even lower, with $800 billion by April 19th. If this trend continues, CEX volumes for April would see a 20% drop from March levels, plummeting to an estimated $1.2 trillion.

Within April, the lowest market volume was seen on April 18, which saw a 40% fall from the previous day. The Block’s chart for the 7-day EMA CEX volume as of April 18 was $34.1 billion, falling from $56.3 billion last Saturday, i.e., April 12, 2025.

Expecting Volatility by May 7

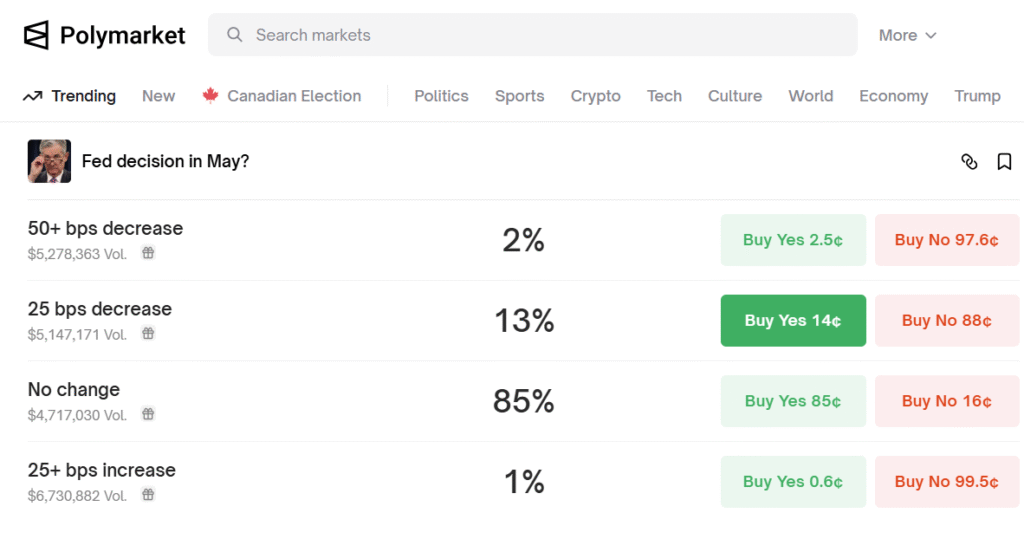

The markets might be positioning for an uncertain FOMC meeting outcome on May 7, against previous expectations for a rate cut of 0.25%.

This change of expectations came after the Fed Chairman Jerome Powell addressed the Economic Club of Chicago, saying that the markets were indeed doing their best and there was no need for a Fed intervention if they plummeted.

However, economic data indicates that there might be room for at least a 0.25% rate cut as US inflation has plummeted to 2.4% in March, very close to its target of 2% and a considerable fall from 3% in February.

These mixed indications have confused the markets, most of which expect an uncertain situation at the next FOMC meeting on May 6 to 7. This confusion is also seen in Polymarket data, where users think there is a high possibility of no change in Fed interest rates.

Blockchain Lab’s Opinion

In our collective experience of over 10 years in the market, we expect huge volatility on May 6 and 7.

- A no-change in rates might crash the markets temporarily.

- A 0.25% rate cut could induce a rally in Bitcoin and broader markets. Bitcoin is already above $85k at press time.

This volatility could send the markets in a directionless manner for a few reasons.

- Crypto markets have reached an oversold zone.

- Donald Trump’s push for pro-crypto policies. An insider from the US government indicated that a Crypto Policy could be ready by June.

Hence, the best action in the current markets would be to either accumulate undervalued cryptos slowly or sit idly.